If You Had Bought Great Wall Pan Asia Holdings (HKG:583) Stock A Year Ago, You'd Be Sitting On A 59% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The nature of investing is that you win some, and you lose some. And there's no doubt that Great Wall Pan Asia Holdings Limited (HKG:583) stock has had a really bad year. In that relatively short period, the share price has plunged 59%. Because Great Wall Pan Asia Holdings hasn't been listed for many years, the market is still learning about how the business performs. It's up 1.6% in the last seven days.

Check out our latest analysis for Great Wall Pan Asia Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Great Wall Pan Asia Holdings share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past. The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

Great Wall Pan Asia Holdings's revenue is actually up 247% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

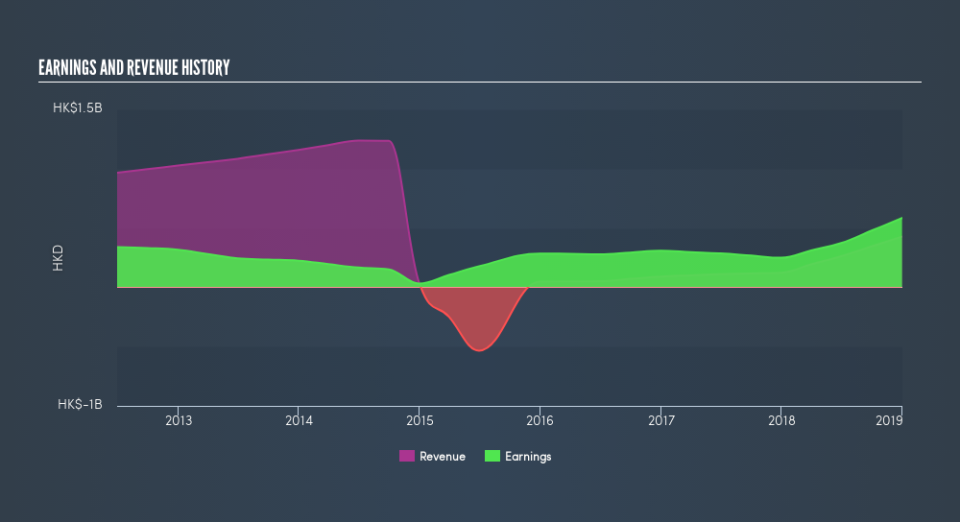

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

If you are thinking of buying or selling Great Wall Pan Asia Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Great Wall Pan Asia Holdings shareholders are down 59% for the year, even worse than the market loss of 10%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 6.0% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. You could get a better understanding of Great Wall Pan Asia Holdings's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.