If You Had Bought Highlight Event and Entertainment (VTX:HLEE) Stock Three Years Ago, You Could Pocket A 95% Gain Today

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. Just take a look at Highlight Event and Entertainment AG (VTX:HLEE), which is up 95%, over three years, soundly beating the market return of 24% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 39%.

View our latest analysis for Highlight Event and Entertainment

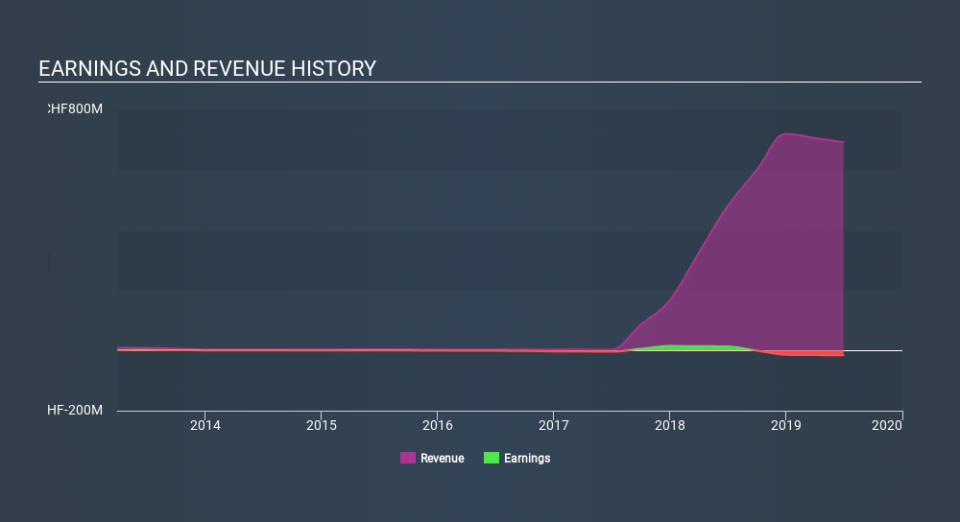

Highlight Event and Entertainment isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Highlight Event and Entertainment's revenue trended up 102% each year over three years. That's well above most pre-profit companies. While the compound gain of 25% per year over three years is pretty good, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at Highlight Event and Entertainment. A window of opportunity may reveal itself with time, if the business can trend to profitability.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We've already covered Highlight Event and Entertainment's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Highlight Event and Entertainment shareholders, and that cash payout contributed to why its TSR of 99%, over the last 3 years, is better than the share price return.

A Different Perspective

We're pleased to report that Highlight Event and Entertainment shareholders have received a total shareholder return of 39% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 14% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 5 warning signs for Highlight Event and Entertainment (2 shouldn't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.