If You Had Bought IDT (NYSE:IDT) Stock Three Years Ago, You'd Be Sitting On A 67% Loss, Today

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term IDT Corporation (NYSE:IDT) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 67% share price collapse, in that time. Furthermore, it's down 18% in about a quarter. That's not much fun for holders.

View our latest analysis for IDT

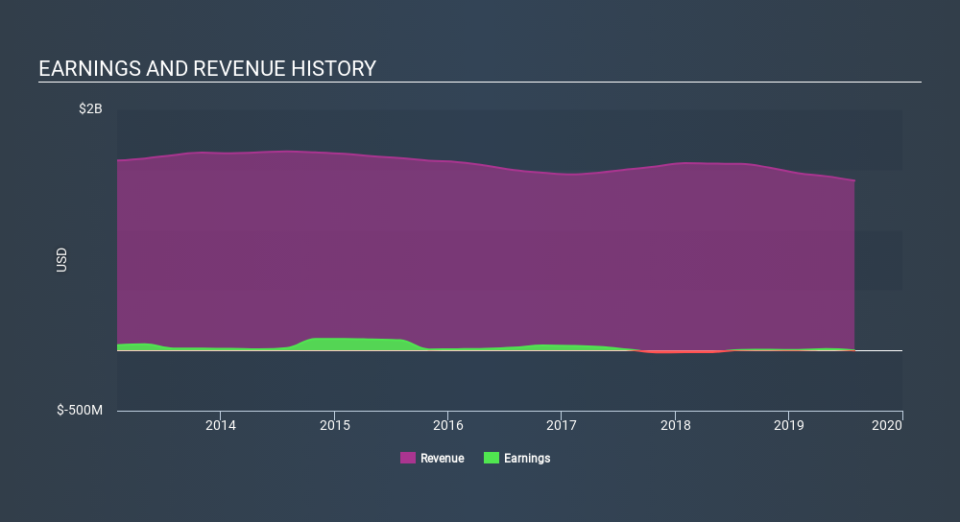

Given that IDT only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years IDT saw its revenue shrink by 0.6% per year. That is not a good result. The share price decline of 31% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling IDT stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered IDT's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that IDT's TSR, which was a 57% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Investors in IDT had a tough year, with a total loss of 9.1%, against a market gain of about 17%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6.2% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.