If You Had Bought New India Assurance (NSE:NIACL) Stock A Year Ago, You'd Be Sitting On A 51% Loss, Today

Taking the occasional loss comes part and parcel with investing on the stock market. Unfortunately, shareholders of The New India Assurance Company Limited (NSE:NIACL) have suffered share price declines over the last year. In that relatively short period, the share price has plunged 51%. Because New India Assurance hasn't been listed for many years, the market is still learning about how the business performs. Even worse, it's down 10.0% in about a month, which isn't fun at all. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for New India Assurance

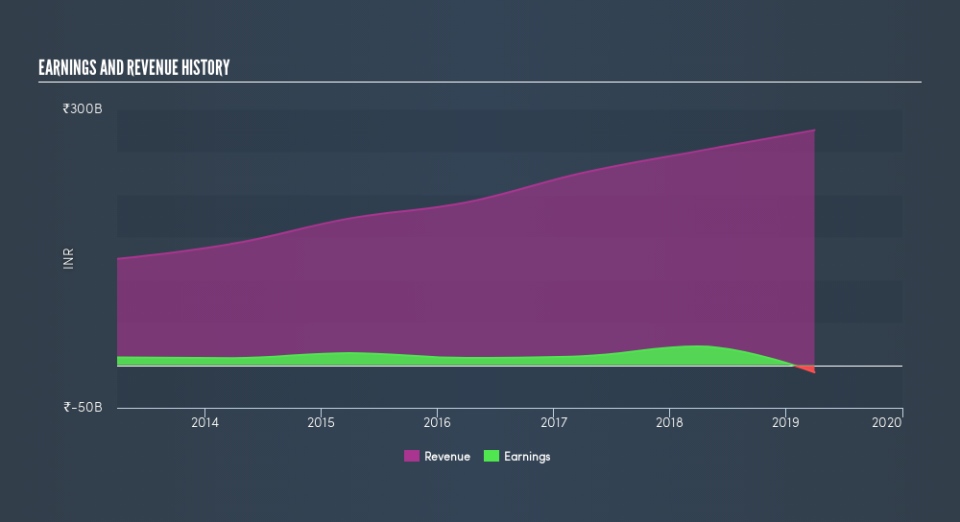

We don't think that New India Assurance's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last twelve months, New India Assurance increased its revenue by 9.7%. While that may seem decent it isn't great considering the company is still making a loss. It's likely this muted growth has contributed to the share price decline of 51% in the last year. We'd want to see evidence that future revenue growth will be stronger before getting too interested. Of course, the market can be too impatient at times. Why not take a closer look at this one so you're ready to pounce if growth does accelerate.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Take a more thorough look at New India Assurance's financial health with this free report on its balance sheet.

A Different Perspective

Given that the market gained 2.0% in the last year, New India Assurance shareholders might be miffed that they lost 51% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 6.7%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Before forming an opinion on New India Assurance you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.