If You Had Bought Kanani Industries (NSE:KANANIIND) Stock Three Years Ago, You'd Be Sitting On A 84% Loss, Today

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Kanani Industries Limited (NSE:KANANIIND); the share price is down a whopping 84% in the last three years. That would be a disturbing experience. The more recent news is of little comfort, with the share price down 45% in a year. Furthermore, it's down 24% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 10% in the same timeframe.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Kanani Industries

While Kanani Industries made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

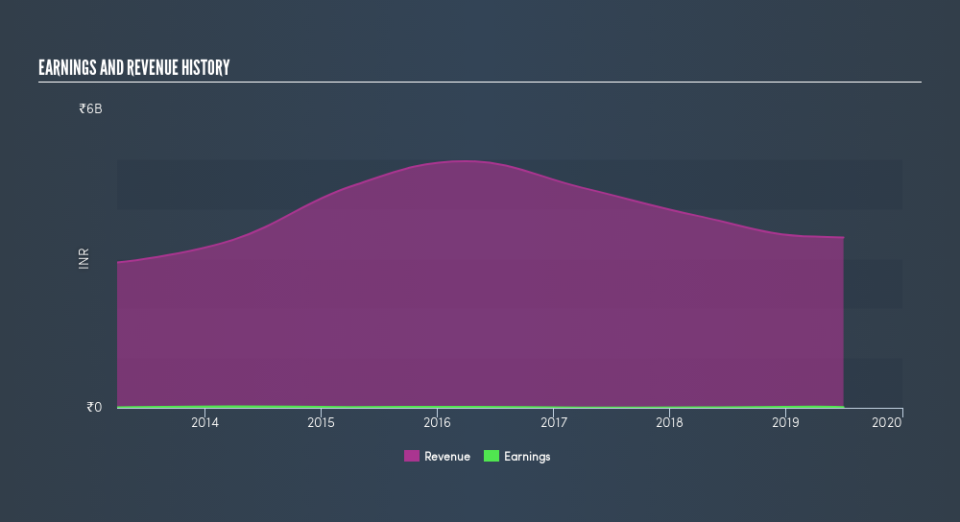

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We regret to report that Kanani Industries shareholders are down 45% for the year. Unfortunately, that's worse than the broader market decline of 13%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 16% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before forming an opinion on Kanani Industries you might want to consider these 3 valuation metrics.

Of course Kanani Industries may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.