If You Had Bought Keck Seng Investments (Hong Kong) (HKG:184) Stock A Year Ago, You'd Be Sitting On A 26% Loss, Today

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Keck Seng Investments (Hong Kong) Limited (HKG:184) shareholders over the last year, as the share price declined 26%. That falls noticeably short of the market return of around -14%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 19% in three years.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Keck Seng Investments (Hong Kong)

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Keck Seng Investments (Hong Kong) share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

Keck Seng Investments (Hong Kong)'s revenue is actually up 3.7% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

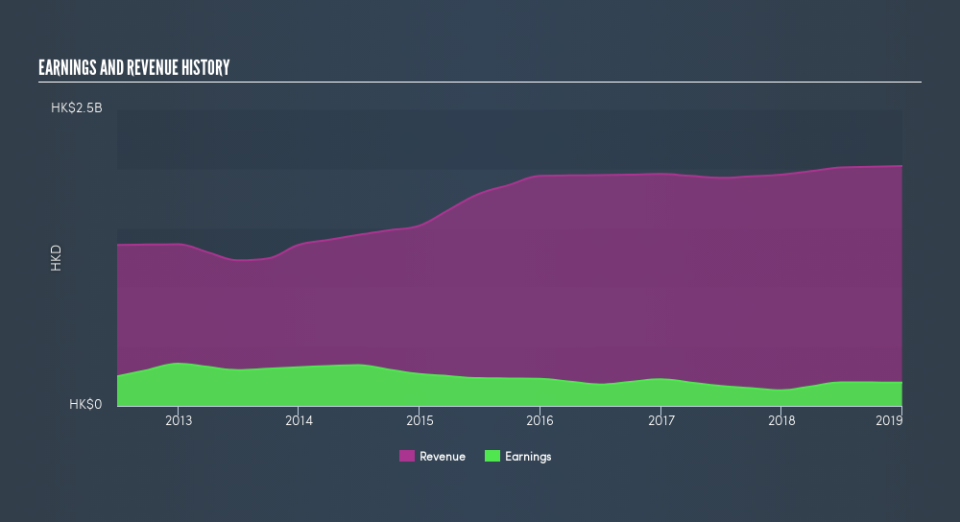

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Keck Seng Investments (Hong Kong)'s total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Keck Seng Investments (Hong Kong)'s TSR of was a loss of 24% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Keck Seng Investments (Hong Kong) shareholders are down 24% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 14%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.1% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Keck Seng Investments (Hong Kong) in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Keck Seng Investments (Hong Kong) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.