If You Had Bought A/S Latvijas Juras medicinas centrs (MUN:UOM) Shares Three Years Ago You'd Have Made 107%

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. To wit, the A/S Latvijas Juras medicinas centrs (MUN:UOM) share price has flown 107% in the last three years. How nice for those who held the stock!

See our latest analysis for A/S Latvijas Juras medicinas centrs

A/S Latvijas Juras medicinas centrs isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

A/S Latvijas Juras medicinas centrs's revenue trended up 4.3% each year over three years. That's not a very high growth rate considering it doesn't make profits. In comparison, the share price rise of 27% per year over the last three years is pretty impressive. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. It may be that the market is pretty optimistic about A/S Latvijas Juras medicinas centrs if you look to the bottom line.

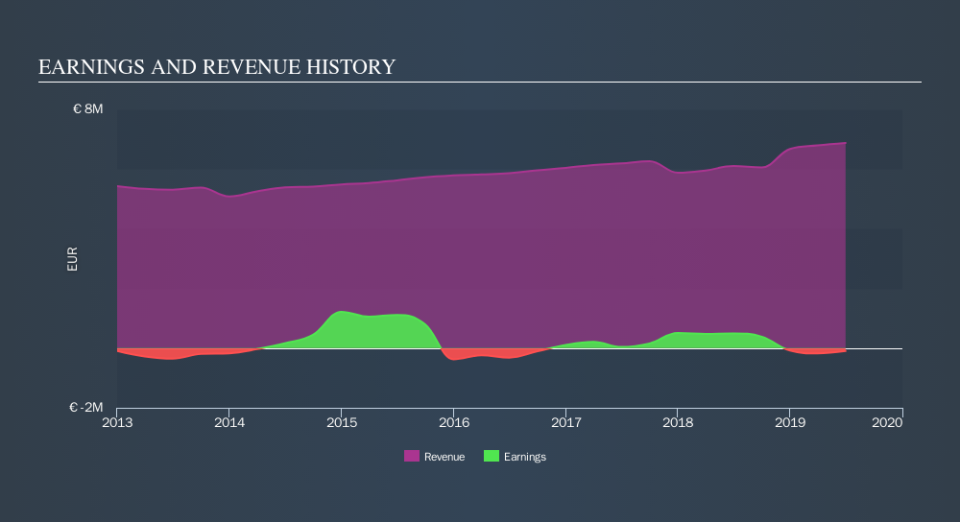

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling A/S Latvijas Juras medicinas centrs stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for A/S Latvijas Juras medicinas centrs the TSR over the last 3 years was 163%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

A/S Latvijas Juras medicinas centrs shareholders are down 27% for the year (even including dividends) , but the market itself is up 1.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 16% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like A/S Latvijas Juras medicinas centrs better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.