If You Had Bought Majestic Gold (CVE:MJS) Stock Three Years Ago, You'd Be Sitting On A 44% Loss, Today

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Majestic Gold Corp. (CVE:MJS) shareholders, since the share price is down 44% in the last three years, falling well short of the market decline of around 6.8%. And more recent buyers are having a tough time too, with a drop of 25% in the last year. It's up 13% in the last seven days.

See our latest analysis for Majestic Gold

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Majestic Gold moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

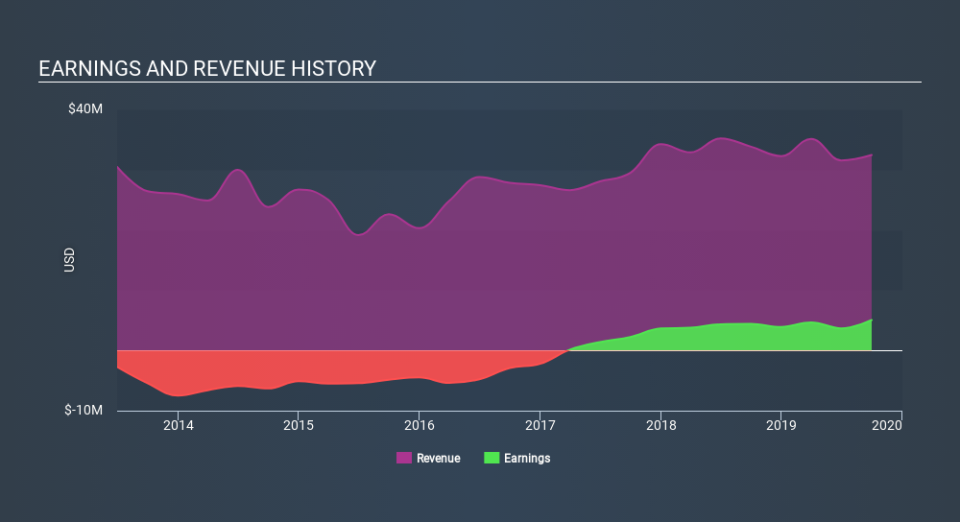

We note that, in three years, revenue has actually grown at a 7.3% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Majestic Gold further; while we may be missing something on this analysis, there might also be an opportunity.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Majestic Gold stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Majestic Gold shareholders are down 25% for the year. Unfortunately, that's worse than the broader market decline of 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 5.2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Majestic Gold better, we need to consider many other factors. For example, we've discovered 2 warning signs for Majestic Gold that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.