If You Had Bought MEIGU Technology Holding Group (HKG:8349) Stock A Year Ago, You'd Be Sitting On A 58% Loss, Today

Taking the occasional loss comes part and parcel with investing on the stock market. And unfortunately for MEIGU Technology Holding Group Limited (HKG:8349) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 58%. Because MEIGU Technology Holding Group hasn't been listed for many years, the market is still learning about how the business performs. The silver lining is that the stock is up 5.9% in about a week.

Check out our latest analysis for MEIGU Technology Holding Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

MEIGU Technology Holding Group managed to increase earnings per share from a loss to a profit, over the last 12 months.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

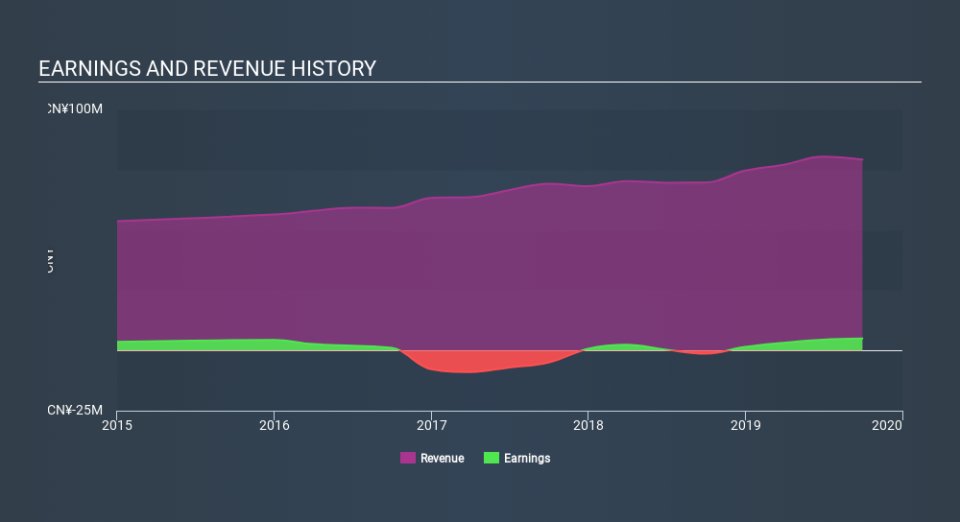

MEIGU Technology Holding Group's revenue is actually up 14% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Given that the market gained 2.7% in the last year, MEIGU Technology Holding Group shareholders might be miffed that they lost 58%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 9.9% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Before deciding if you like the current share price, check how MEIGU Technology Holding Group scores on these 3 valuation metrics.

Of course MEIGU Technology Holding Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.