If You Had Bought Mermaid Maritime (SGX:DU4) Stock Five Years Ago, You'd Be Sitting On A 83% Loss, Today

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Mermaid Maritime Public Company Limited (SGX:DU4) for five whole years - as the share price tanked 83%. And it's not just long term holders hurting, because the stock is down 40% in the last year. Shareholders have had an even rougher run lately, with the share price down 10% in the last 90 days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Mermaid Maritime

Mermaid Maritime isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

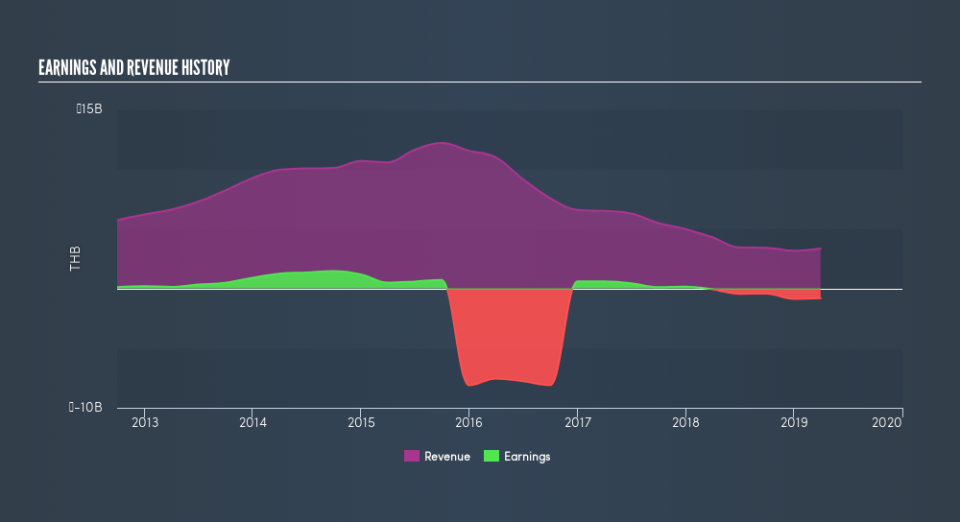

In the last five years Mermaid Maritime saw its revenue shrink by 24% per year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 30% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Mermaid Maritime's financial health with this free report on its balance sheet.

A Different Perspective

Mermaid Maritime shareholders are down 40% for the year, but the market itself is up 2.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 29% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Mermaid Maritime better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.