If You Had Bought Mincor Resources (ASX:MCR) Shares Three Years Ago You'd Have Made 334%

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. One such superstar is Mincor Resources NL (ASX:MCR), which saw its share price soar 334% in three years. In more good news, the share price has risen 8.6% in thirty days. But the price may well have benefitted from a buoyant market, since stocks have gained 11% in the last thirty days.

See our latest analysis for Mincor Resources

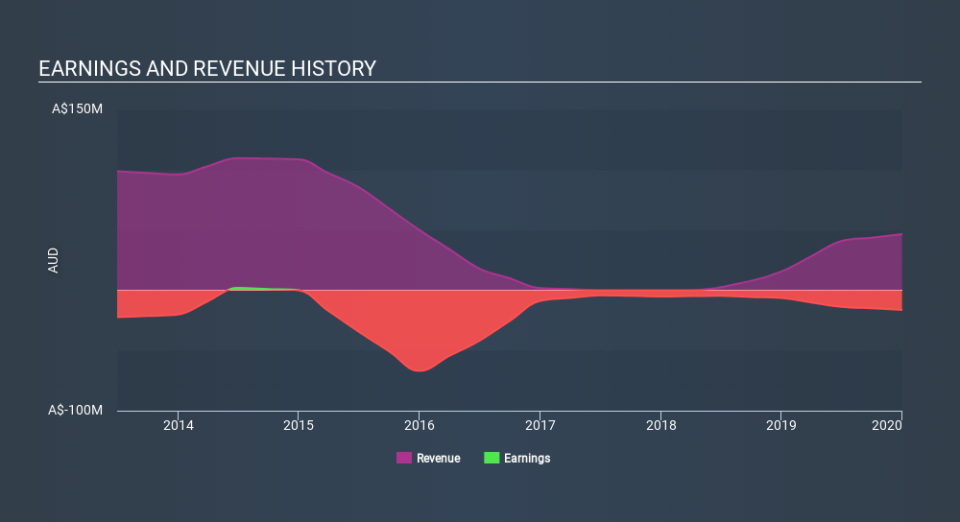

Because Mincor Resources made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Mincor Resources's revenue trended up 109% each year over three years. That's well above most pre-profit companies. And it's not just the revenue that is taking off. The share price is up 63% per year in that time. Despite the strong run, top performers like Mincor Resources have been known to go on winning for decades. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Mincor Resources's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Mincor Resources has rewarded shareholders with a total shareholder return of 58% in the last twelve months. That gain is better than the annual TSR over five years, which is 1.3%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Mincor Resources (1 shouldn't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.