If You Had Bought NewOcean Energy Holdings (HKG:342) Stock Five Years Ago, You'd Be Sitting On A 66% Loss, Today

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. To wit, the NewOcean Energy Holdings Limited (HKG:342) share price managed to fall 66% over five long years. That's not a lot of fun for true believers. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days. Of course, this share price action may well have been influenced by the 9.0% decline in the broader market, throughout the period.

View our latest analysis for NewOcean Energy Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

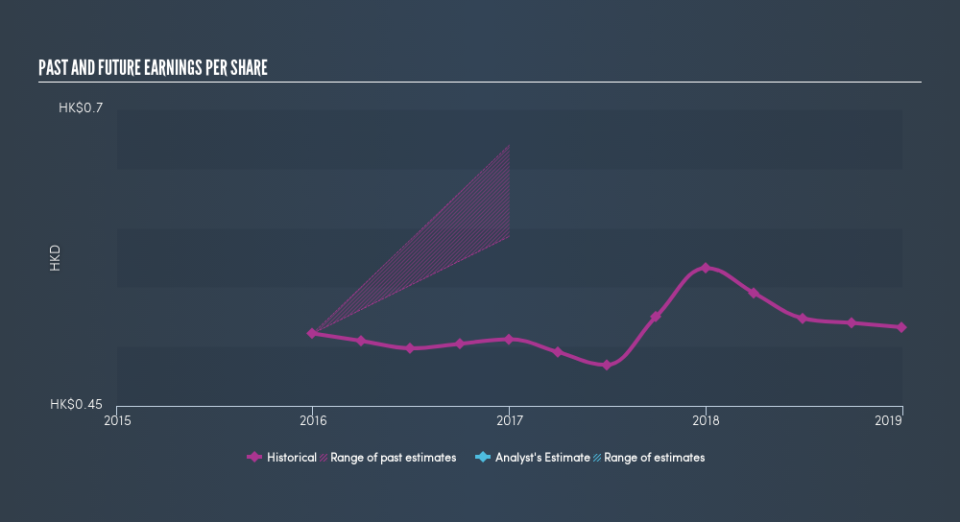

Looking back five years, both NewOcean Energy Holdings's share price and EPS declined; the latter at a rate of 1.2% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 19% per year, over the period. This implies that the market is more cautious about the business these days. The less favorable sentiment is reflected in its current P/E ratio of 3.18.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While the broader market lost about 6.9% in the twelve months, NewOcean Energy Holdings shareholders did even worse, losing 16%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. However, the loss over the last year isn't as bad as the 19% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.