If You Had Bought Northeast Electric Development (HKG:42) Stock Three Years Ago, You'd Be Sitting On A 81% Loss, Today

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Northeast Electric Development Company Limited (HKG:42) investors who have held the stock for three years as it declined a whopping 81%. That would certainly shake our confidence in the decision to own the stock. The falls have accelerated recently, with the share price down 23% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Northeast Electric Development

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Northeast Electric Development moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

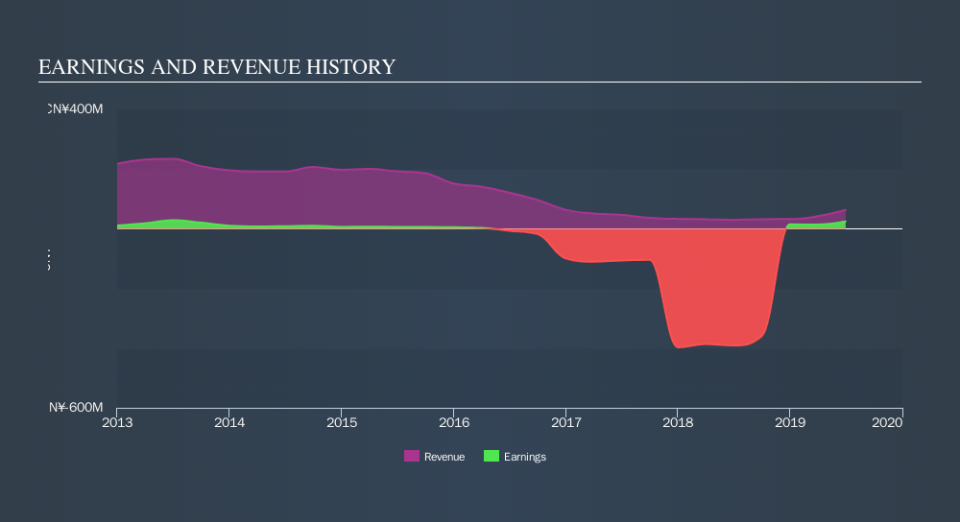

Arguably the revenue decline of 35% per year has people thinking Northeast Electric Development is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Northeast Electric Development's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 3.0% in the twelve months, Northeast Electric Development shareholders did even worse, losing 9.1%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, longer term shareholders are suffering worse, given the loss of 25% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Is Northeast Electric Development cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.