If You Had Bought NZME (NZSE:NZM) Stock Three Years Ago, You'd Be Sitting On A 38% Loss, Today

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term NZME Limited (NZSE:NZM) shareholders have had that experience, with the share price dropping 38% in three years, versus a market return of about 56%. And the ride hasn't got any smoother in recent times over the last year, with the price 31% lower in that time. The falls have accelerated recently, with the share price down 24% in the last three months.

See our latest analysis for NZME

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, NZME moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

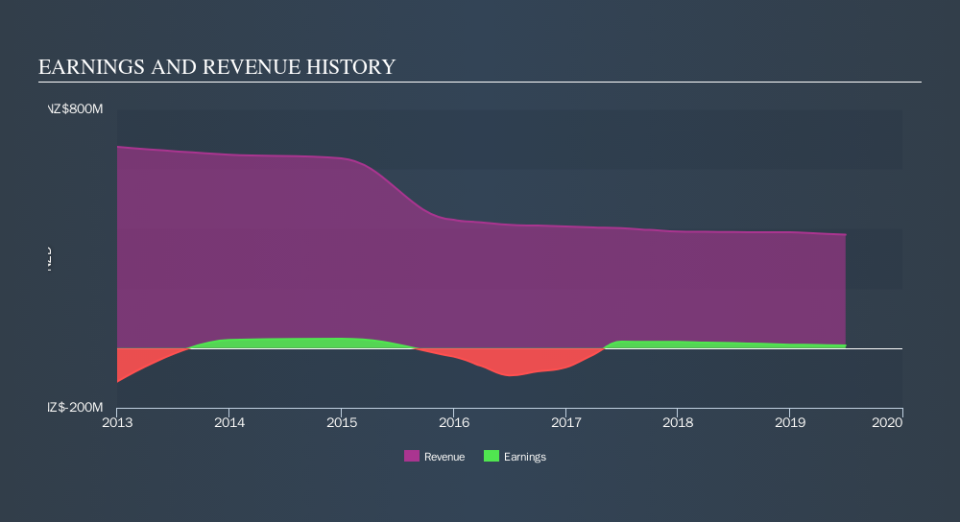

With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. There doesn't seem to be any clear correlation between the fundamental business metrics and the share price. That could mean that the stock was previously overrated, or it could spell opportunity now.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that NZME has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at NZME's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between NZME's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for NZME shareholders, and that cash payout explains why its total shareholder loss of 20%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

The last twelve months weren't great for NZME shares, which cost holders 31%, while the market was up about 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 7.3% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Before forming an opinion on NZME you might want to consider these 3 valuation metrics.

But note: NZME may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.