If You Had Bought Red 5 (ASX:RED) Stock A Year Ago, You Could Pocket A 315% Gain Today

It hasn't been the best quarter for Red 5 Limited (ASX:RED) shareholders, since the share price has fallen 12% in that time. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. In fact, it is up 315% in that time. So the recent fall isn't enough to negate the good performance. The real question is whether the fundamental business performance can justify the strong increase over the long term.

Check out our latest analysis for Red 5

Red 5 isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Red 5 saw its revenue grow by 100%. That's stonking growth even when compared to other loss-making stocks. But the share price has really rocketed in response gaining 315% as previously mentioned. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

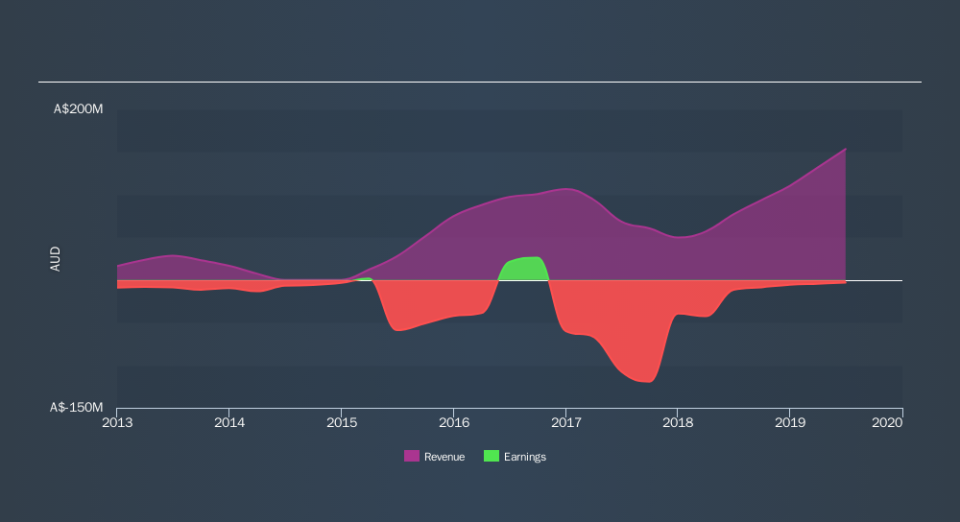

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Red 5 has rewarded shareholders with a total shareholder return of 315% in the last twelve months. That's better than the annualised return of 28% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Red 5 in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Red 5 may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.