If You Had Bought Sequoia Financial Group (ASX:SEQ) Stock Three Years Ago, You'd Be Sitting On A 42% Loss, Today

It's nice to see the Sequoia Financial Group Limited (ASX:SEQ) share price up 13% in a week. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 42% in the last three years, falling well short of the market return.

Check out our latest analysis for Sequoia Financial Group

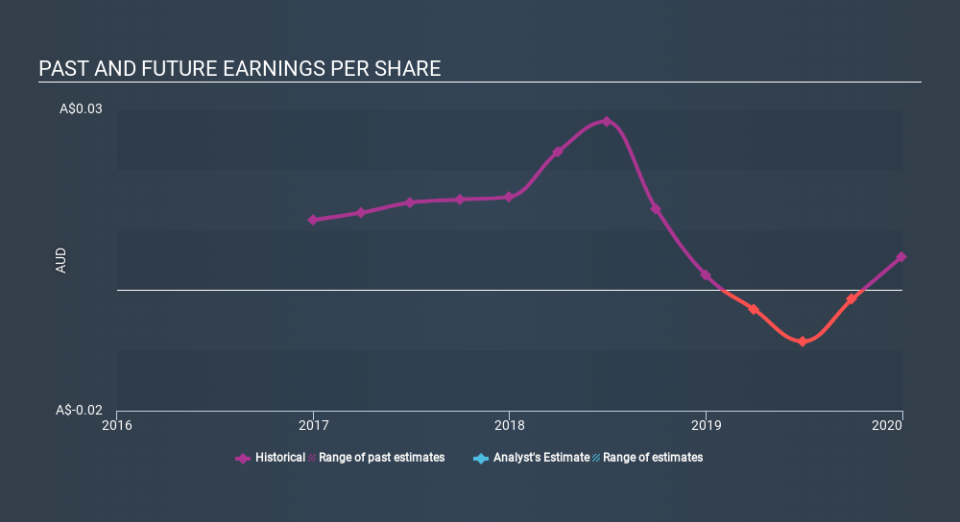

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years that the share price fell, Sequoia Financial Group's earnings per share (EPS) dropped by 22% each year. This fall in the EPS is worse than the 17% compound annual share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Sequoia Financial Group's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Sequoia Financial Group shareholders are down 25% for the year. Unfortunately, that's worse than the broader market decline of 19%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Sequoia Financial Group is showing 3 warning signs in our investment analysis , you should know about...

Sequoia Financial Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.