If You Had Bought Siemens Gamesa Renewable Energy (BME:SGRE) Shares A Year Ago You'd Have Made 18%

It hasn't been the best quarter for Siemens Gamesa Renewable Energy, S.A. (BME:SGRE) shareholders, since the share price has fallen 12% in that time. But that doesn't change the fact that the returns over the last year have been pleasing. After all, the share price is up a market-beating 18% in that time.

Check out our latest analysis for Siemens Gamesa Renewable Energy

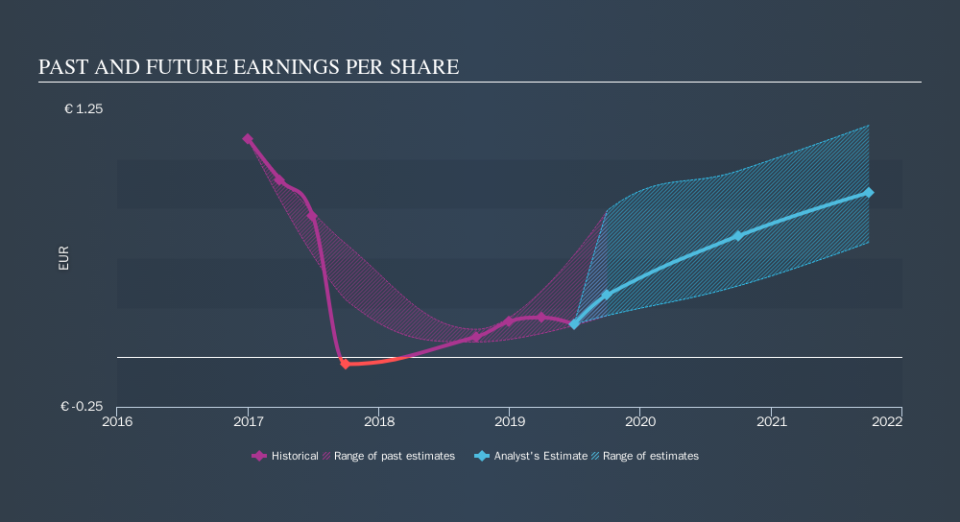

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Siemens Gamesa Renewable Energy grew its earnings per share (EPS) by 143%. This EPS growth is significantly higher than the 18% increase in the share price. So it seems like the market has cooled on Siemens Gamesa Renewable Energy, despite the growth. Interesting. Having said that, the market is still optimistic, given the P/E ratio of 81.21.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Siemens Gamesa Renewable Energy has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

Siemens Gamesa Renewable Energy boasts a total shareholder return of 18% for the last year. We regret to report that the share price is down 12% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. Before spending more time on Siemens Gamesa Renewable Energy it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.