If You Had Bought SPT Energy Group (HKG:1251) Stock Five Years Ago, You'd Be Sitting On A 59% Loss, Today

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. Zooming in on an example, the SPT Energy Group Inc. (HKG:1251) share price dropped 59% in the last half decade. That's not a lot of fun for true believers. Furthermore, it's down 22% in about a quarter. That's not much fun for holders.

Check out our latest analysis for SPT Energy Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

SPT Energy Group became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

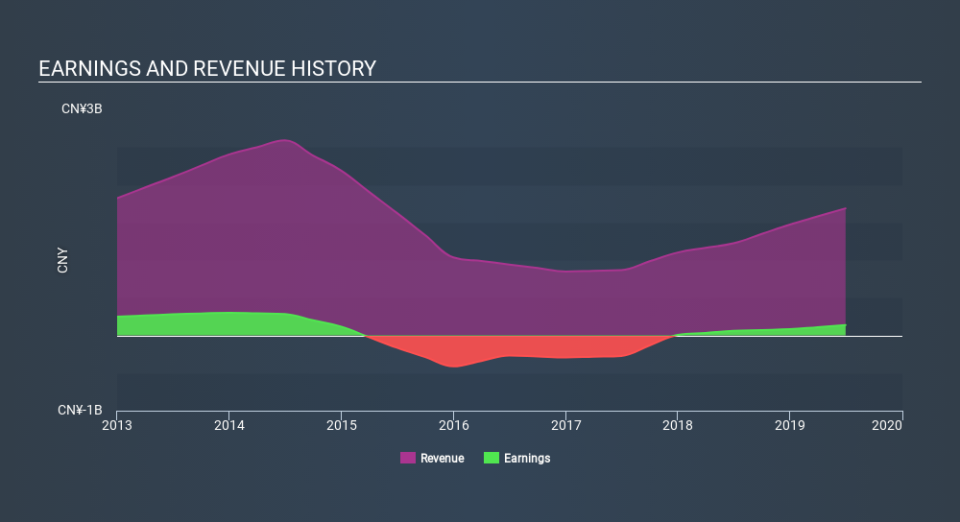

It could be that the revenue decline of 11% per year is viewed as evidence that SPT Energy Group is shrinking. This has probably encouraged some shareholders to sell down the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how SPT Energy Group has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that SPT Energy Group has rewarded shareholders with a total shareholder return of 7.7% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 16% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Before deciding if you like the current share price, check how SPT Energy Group scores on these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.