If You Had Bought TAKKT (ETR:TTK) Stock Three Years Ago, You'd Be Sitting On A 46% Loss, Today

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term TAKKT AG (ETR:TTK) shareholders, since the share price is down 46% in the last three years, falling well short of the market return of around 6.8%. There was little comfort for shareholders in the last week as the price declined a further 4.7%.

Check out our latest analysis for TAKKT

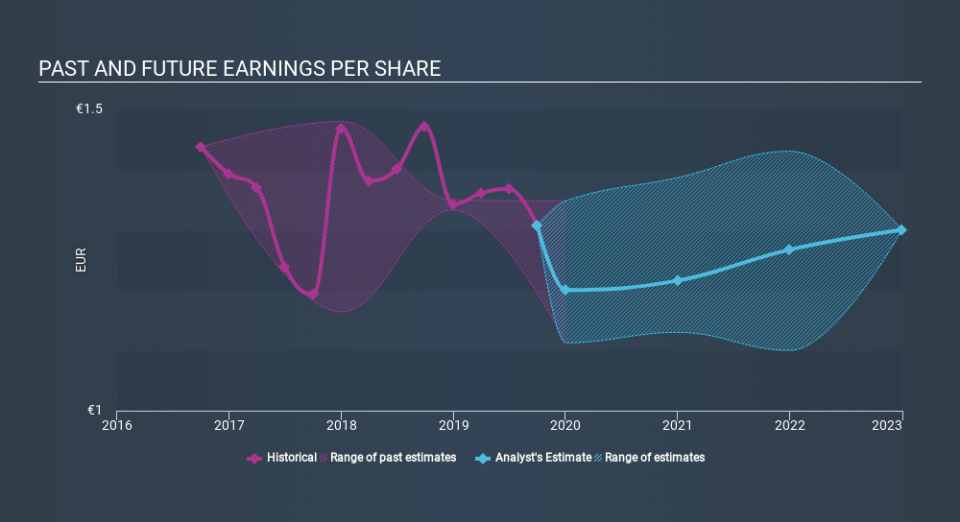

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

TAKKT saw its EPS decline at a compound rate of 3.1% per year, over the last three years. The share price decline of 19% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 9.09.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into TAKKT's key metrics by checking this interactive graph of TAKKT's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for TAKKT the TSR over the last 3 years was -39%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 9.8% in the last year, TAKKT shareholders lost 14% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.9% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that TAKKT is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.