If You Had Bought UMP Healthcare Holdings (HKG:722) Stock A Year Ago, You'd Be Sitting On A 14% Loss, Today

One simple way to benefit from a rising market is to buy an index fund. But in any given year a good portion of stocks will fall short of that. For example, the UMP Healthcare Holdings Limited (HKG:722) share price fell 14% in the last year, slightly below the market return of around -13%. Longer term investors have fared much better, since the share price is up 6.0% in three years. The good news is that the stock is up 1.3% in the last week.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for UMP Healthcare Holdings

While UMP Healthcare Holdings made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last twelve months, UMP Healthcare Holdings increased its revenue by 30%. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 14%. You might even wonder if the share price was previously over-hyped. But if revenue keeps growing, then at a certain point the share price would likely follow.

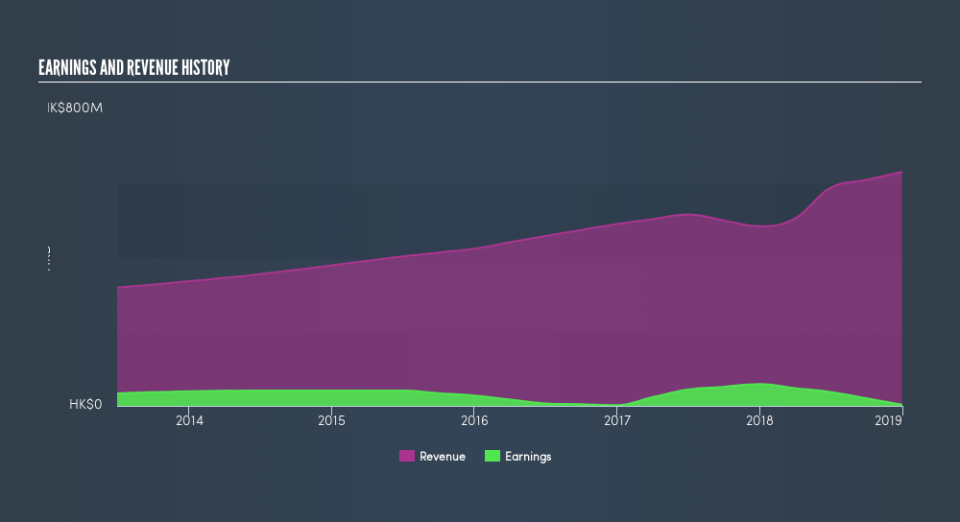

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

If you are thinking of buying or selling UMP Healthcare Holdings stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered UMP Healthcare Holdings's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. UMP Healthcare Holdings's TSR of was a loss of 13% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

With a loss of 13% in the last year (even including dividends), UMP Healthcare Holdings's returns haven't been too far from the market return of -13%. Over the last three years, shareholders booked a gain of 3.7% per year - better than the last year, that's for sure!. It could be worth doing some further research, because it may be that the long term future remains bright (and the lower share price an opportunity). You could get a better understanding of UMP Healthcare Holdings's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course UMP Healthcare Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.