If You Had Bought Waberer's International Nyrt (BST:3WB) Stock A Year Ago, You'd Be Sitting On A 49% Loss, Today

While it may not be enough for some shareholders, we think it is good to see the Waberer's International Nyrt. (BST:3WB) share price up 10% in a single quarter. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 49% in one year, under-performing the market.

View our latest analysis for Waberer's International Nyrt

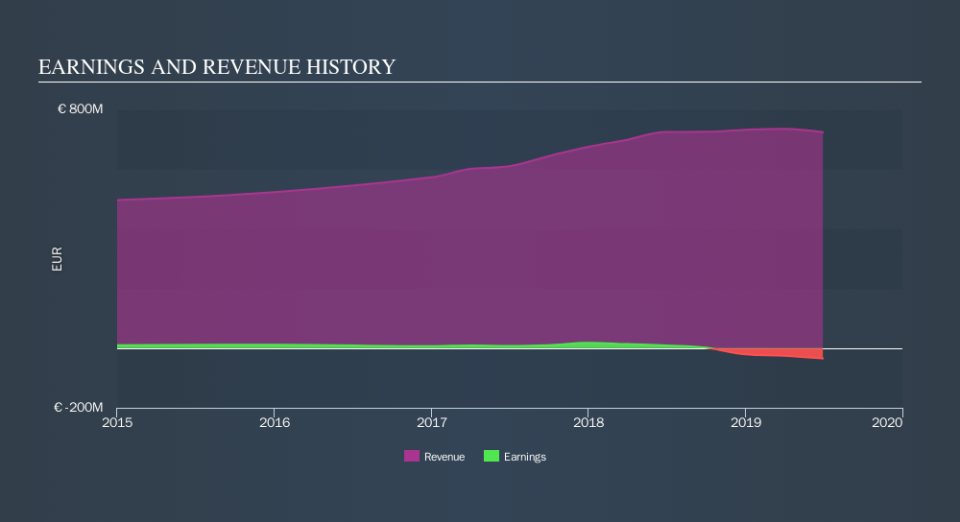

Because Waberer's International Nyrt is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Waberer's International Nyrt's revenue didn't grow at all in the last year. In fact, it fell 0.2%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 49% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While Waberer's International Nyrt shareholders are down 49% for the year, the market itself is up 7.0%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 10% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.