If You Had Bought Wai Chi Holdings (HKG:1305) Stock Three Years Ago, You'd Be Sitting On A 49% Loss, Today

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Wai Chi Holdings Company Limited (HKG:1305) shareholders have had that experience, with the share price dropping 49% in three years, versus a market return of about 33%. Furthermore, it's down 14% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 9.1% in the same period.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Wai Chi Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

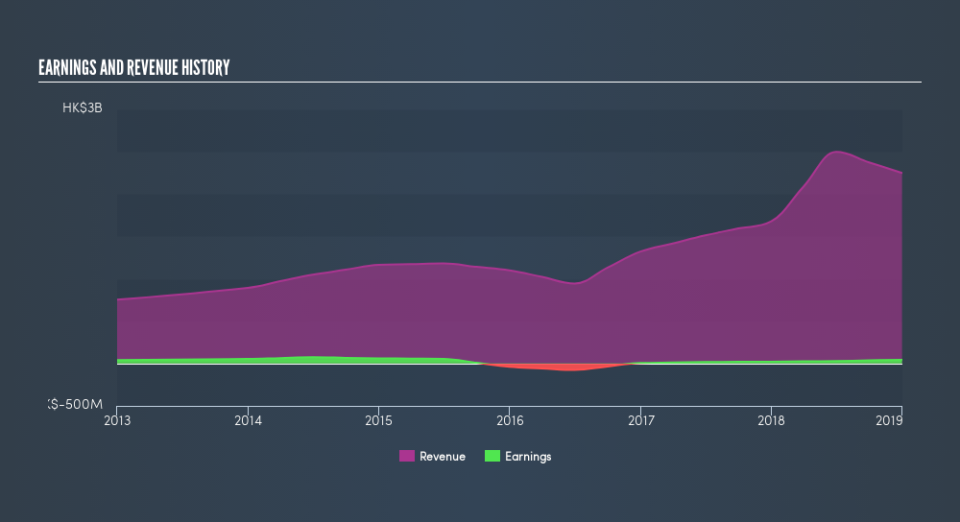

During five years of share price growth, Wai Chi Holdings moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

We note that, in three years, revenue has actually grown at a 32% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Wai Chi Holdings more closely, as sometimes stocks fall unfairly. This could present an opportunity.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

This free interactive report on Wai Chi Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's never nice to take a loss, Wai Chi Holdings shareholders can take comfort that their trailing twelve month loss of 4.5% wasn't as bad as the market loss of around -14%. Furthermore, the stock lost shareholders 20% per year over three years, so the one-year return was better in a relative sense. It could well be that the business has begun to stabilize, though the recent returns are hardly impressive. Before forming an opinion on Wai Chi Holdings you might want to consider these 3 valuation metrics.

We will like Wai Chi Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.