If You Had Bought Zhejiang Chang'an Renheng Technology (HKG:8139) Shares A Year Ago You'd Have Made 12%

The last three months have been tough on Zhejiang Chang'an Renheng Technology Co., Ltd. (HKG:8139) shareholders, who have seen the share price decline a rather worrying 52%. But that doesn't change the fact that the returns over the last year have been pleasing. To wit, it had solidly beat the market, up 12%.

View our latest analysis for Zhejiang Chang'an Renheng Technology

We don't think that Zhejiang Chang'an Renheng Technology's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last twelve months, Zhejiang Chang'an Renheng Technology's revenue grew by 2.9%. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably largely reflected in the share price, which is up 12%. While not a huge gain tht seems pretty reasonable. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

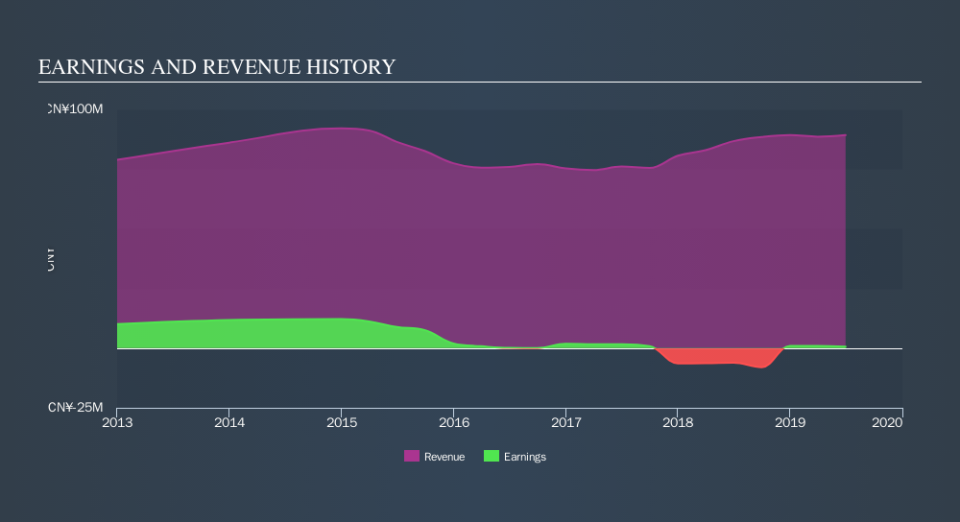

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We're pleased to report that Zhejiang Chang'an Renheng Technology rewarded shareholders with a total shareholder return of 12% over the last year. That's better than the annualized TSR of 2.2% over the last three years. Given the track record of solid returns over varying time frames, it might be worth putting Zhejiang Chang'an Renheng Technology on your watchlist. You could get a better understanding of Zhejiang Chang'an Renheng Technology's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Zhejiang Chang'an Renheng Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.