If You Had Bought Zurich Insurance Group (VTX:ZURN) Stock Three Years Ago, You Could Pocket A 41% Gain Today

By buying an index fund, investors can approximate the average market return. But if you pick the right individual stocks, you could make more than that. Just take a look at Zurich Insurance Group AG (VTX:ZURN), which is up 41%, over three years, soundly beating the market return of 24% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 38% , including dividends .

View our latest analysis for Zurich Insurance Group

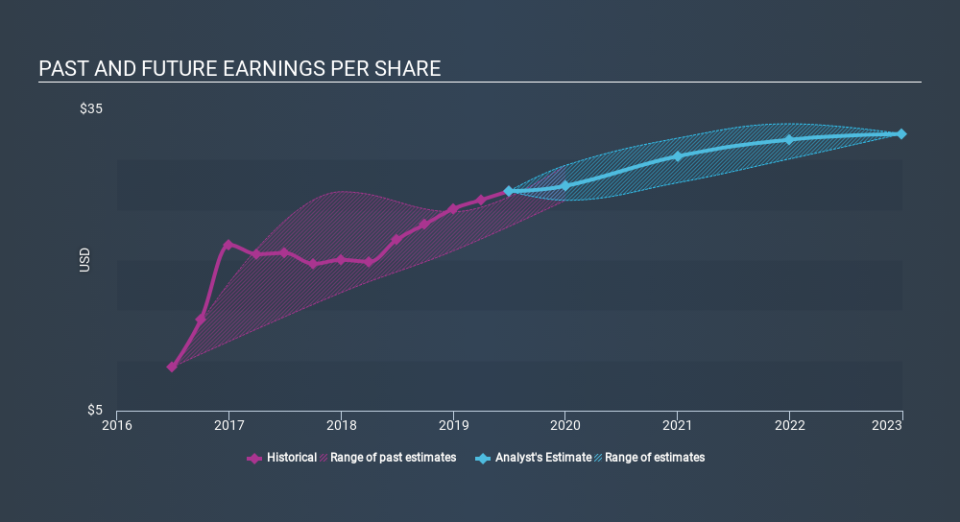

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Zurich Insurance Group was able to grow its EPS at 42% per year over three years, sending the share price higher. The average annual share price increase of 12% is actually lower than the EPS growth. So it seems investors have become more cautious about the company, over time.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Zurich Insurance Group has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Zurich Insurance Group stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Zurich Insurance Group the TSR over the last 3 years was 69%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Zurich Insurance Group shareholders have received a total shareholder return of 38% over one year. That's including the dividend. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Keeping this in mind, a solid next step might be to take a look at Zurich Insurance Group's dividend track record. This free interactive graph is a great place to start.

We will like Zurich Insurance Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.