Half of ambulance rides yield surprise medical bills. What's being done to protect people?

When people dial 911, perhaps the last thing they think about is how much the ambulance ride will cost.

But a report released Tuesday by U.S. PIRG Education Trust shows ambulance companies routinely bill out-of-network charges. This happens when an insurance plan's network doesn't include the public or private ambulance company.

Even after an insurer pays a portion of the charges, about half of consumers are billed more. These extra charges add up to about $129 million each year, according to U.S. PIRG.

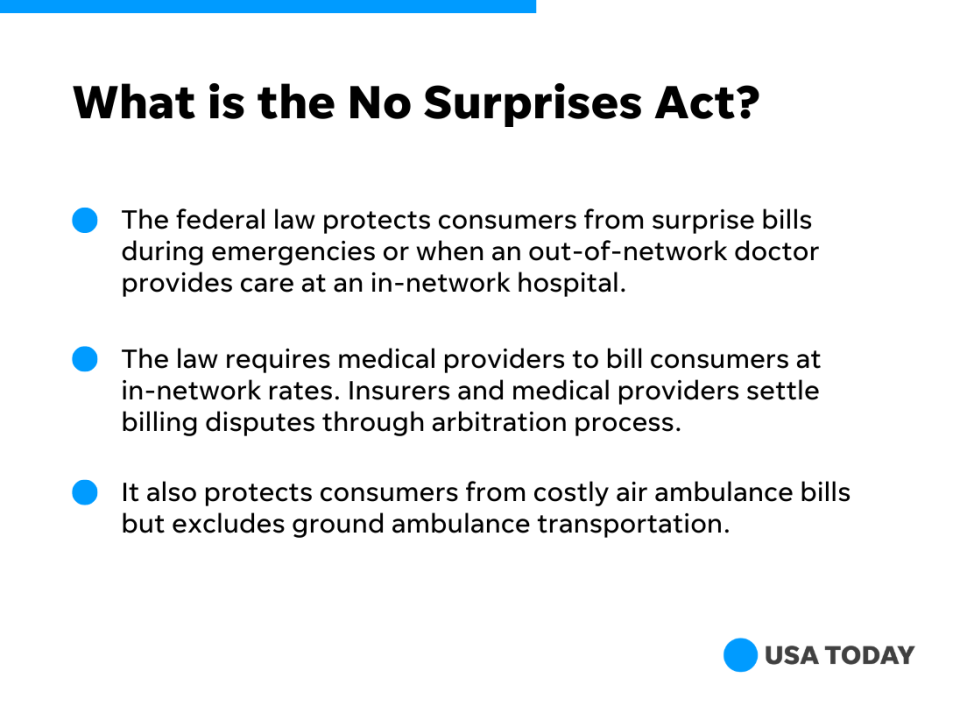

Congress passed a law creating an arbitration process as of January 2022 to protect consumers from surprise bills during emergencies or when an out-of-network doctor provides care at an in-network hospital. The federal law, called the No Surprises Act, also protects consumers from costly air ambulance bills – but it doesn't address more common ground ambulance transports.

"This was the big gap in the No Surprises Act and it should be closed," said Patricia Kelmar, senior director of health care campaigns at U.S. PIRG Education Fund. "Three million insured people every year are going in an ambulance for an emergency, and half of those folks are exposed to a surprise bill."

What to know about surprise ambulance billing

Ground ambulances were excluded from the No Surprises Act, in part, because of the complex regulatory nature and large number of stakeholders. Ambulance companies are usually regulated by states and local municipalities.

About 51% of emergency ambulance rides included out-of-network charges that potentially exposed patients to surprise bills, according to Kaiser Family Foundation.

The median cost for a surprise ambulance bill was $450, a 2020 study found, but rates vary by state and region. The median surprise bill in Massachusetts and Minnesota exceeded $1,000 while California had the most expensive average bills at more than $1,200.

Fire departments or other local government entities provided nearly two-thirds of ambulance rides in 2020 while private ambulance companies handled 30% of rides, according to Kaiser Family Foundation.

Do states protect consumers from ambulance bills?

Ten states have laws to limit ambulances from billing patients beyond what their insurance companies pay, but those restrictions apply only to state-regulated health insurance plans and protections vary. For example, Maryland's protections apply only to publicly owned ambulances and Colorado's prohibits private ambulances from such balance billing, according to the report.

The states with protections:

Colorado

Delaware

Florida

Illinois

Maine

Maryland

New York

Ohio

Vermont

West Virginia

A major loophole: State bans don't apply to most employer-provided health insurance plans, which are regulated under a Department of Labor law called the Employee Retirement Income Security Act.

"That's why we really do need a federal law to make sure that all insured patients have protection from surprise bills," Kelmar said.

How is the federal government addressing ambulance billing?

A federal advisory committee created by the No Surprises Act is set to meet in January for the first time. It then has 180 days to make detailed recommendations on fee disclosures and strategies to protect consumers from surprise buildings.

U.S. PIRG recommends Congress amend the No Surprises Act to protect consumers from surprise ambulance bills. The federal law has prevented as many as 9 million surprise medical bills through September, according to an analysis by Blue Cross Blue Shield Association and America’s Health Insurance Plans, a health insurance industry group.

Why consumers need protection

Because people have no chance to compare prices or seek a better deal during an emergency, consumer advocates say it's unfair to stick patients with surprise bills.

"When you call 911, you don't know what ambulance is going to come," said Eileen Appelbaum, Co-Director of the Center for Economic and Policy Research, a progressive think tank.

Go deeper

As surprise billing ban nears, doctors and hospitals scramble to delay federal law

'Almost useless': Patients, advocates critical of federal pace to unlock hospital price

Private equity’s stealthy takeover of health care in multiple cities, specialties

Ken Alltucker is on Twitter at @kalltucker, or can be emailed at alltuck@usatoday.com.

This article originally appeared on USA TODAY: Ambulance rides yield surprise medical bills: What's being done?