The hands-on way Falmouth High School students are learning real-life budget skills

FALMOUTH — Close to 200 Falmouth High School students had money to burn on Friday.

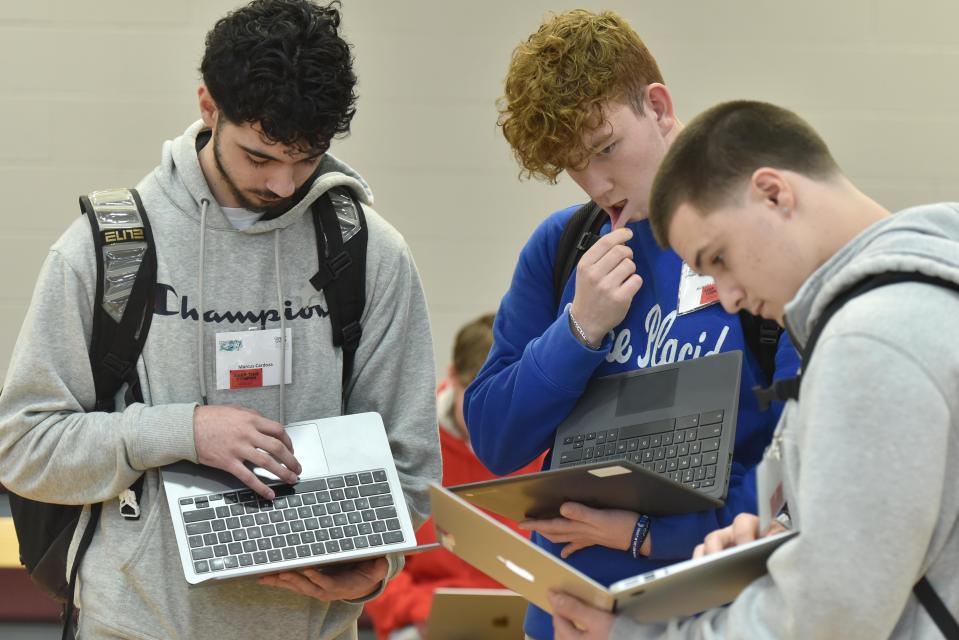

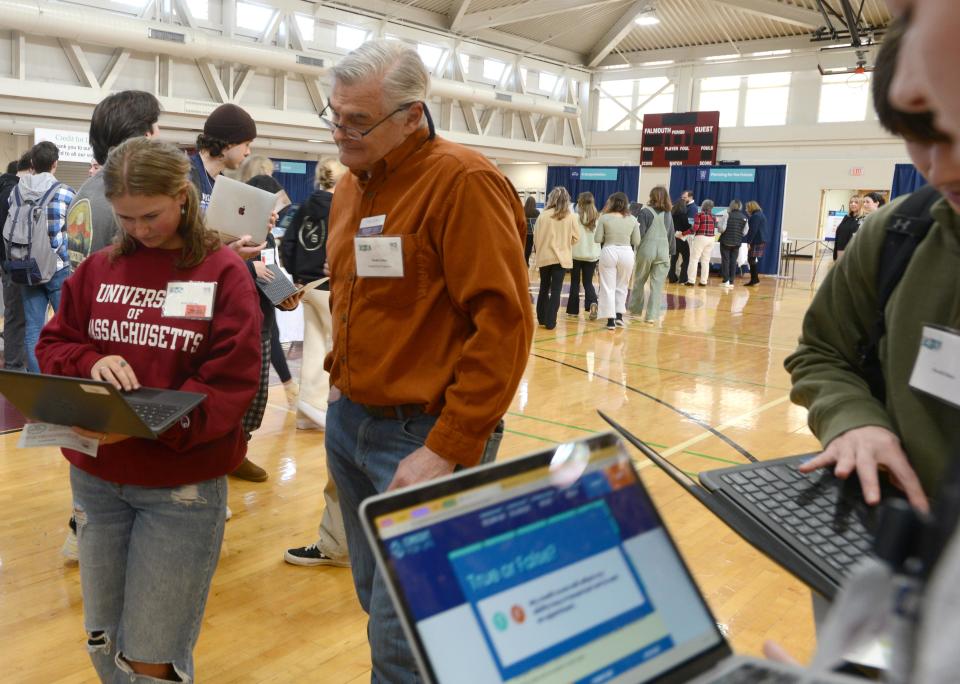

The students were released into a Credit for Life Fair, armed with laptops and a software program, a career they were considering — with its starting salary.

Their task was to take those theoretical salaries and decide how to spend the money on housing, transportation, food, health care and six other necessities. Their choices subtracted set amounts from their salaries, leaving them with the amount of money they might have left over after covering necessities.

Expenses added up quickly.

"Teachers don’t make the most money, but it's what I want to do, so planning ahead is useful," said student Livia Johnson who started the fair making $45,000 as a music teacher.

This is the 10th year Falmouth High has held the fair. Business teacher Janet Rocha has spearheaded the fair and the career pathway students can take. Jim Curran, a Cape Cod Five financial know-how program manager, spoke to the students a few weeks ago. Then students had the option of getting an online certificate from FitMoney, a nonprofit whose goal is to teach financial literacy to students. The third step was the fair, when students saw how expensive life can be even after getting a full-time job.

“We teach the behavior of borrowing and smart spending,” said FitMoney Executive Director Jessica Pelletier. “Financial literacy is just that: behavioral.”

Workers can have 'lifestyle creep' when it comes to spending their salaries.

Curran, with Cape Cod 5, has spoken to students, youth groups, employees of area businesses, community college students and seniors. He’s talked with people just starting out as well as those about to retire. One of his favorite tools is a Chinese proverb: The best time to plant a tree is 20 years ago; the second-best time is now.

He asks high school students to think about the habits they can put into place now. It’s all about learning to make mindful decisions about budgeting and money rather than just checking a bank account balance to see what you can afford, he said. He cited figures showing that 28% of those making $55,000 a year are living paycheck to paycheck, but so are those making $175,000 a year.

“It’s lifestyle creep,” he said.

More:Female cadets excel at Mass. Maritime

Curran understands the vicissitudes of financial wellness in a unique way. He made lots of money at a job in Washington, D.C. before he lost everything. Recovery and starting over from scratch on Cape Cod required him to keep careful watch on his finances, keeping daily track of what he earned and spent. When he tells students that story, the room changes, he said.

“You see their shoulders drop,” he said. “They aren’t being judged.’

More:Cape program helps out of school youth

Three seniors started out the fair with first-year annual salaries ranging from $45,000 to $69,000.

Johnson, with her music teacher salary, along with Krystyna Wills and Gracie Howes teamed up at the fair to go through the 10 required booths: Wills started out with $66,900 (international business) and Howes with $69,000 (first-year psychologist).

Each had to select options for housing, transportation, healthcare, food, retirement and fun. Would they live at home with their parents or rent a one-bedroom apartment? Would they buy a new car or use public transportation? Would they get a college degree or learn a trade, save $50 monthly or $100, join a health club or a free sports league. Each booth required students to make selections and each selection had a cost. That cost was subtracted from their salaries.

Students had to decide if they'd pay their bills with savings, or use a debit card or credit card. If they ran out of money after making selections, they could choose to work a part-time job from another list. Or they could go back and change their original selections to less expensive ones.

“We teach them the process,” Curran said. “It’s important to run the numbers ahead of time rather than after. You might qualify for a vehicle and get a loan, and not realize that’s too much of your income. We tell them this is process, adjust it as needed.”

The fair can help students learn the importance of saving and having a budget.

Cape Cod Five volunteer Andrew Aguiar credits the fair with helping him when he was a senior at Sturgis Charter Public School. The experience taught him the importance of saving, and having a budget.

"It's a great life skill,” he said. "It sparked the idea of future planning after high school.”

Seniors Matthew Quinlan and Jack Braga were glad to talk with volunteers at each booth, and the budget counselors who were available to go over their final selections. The help with budgeting and making financial decisions was especially helpful, Quinlan added. Having a group of people guide him through his finances was another plus, Braga said.

Especially down the road, he said.

Contact Denise Coffey at dcoffey@capecodonline.com. Follow her on Twitter: @DeniseCoffeyCCT.

Gain access to premium Cape Cod Times content by subscribing.

This article originally appeared on Cape Cod Times: Spending, saving, budget lessons at Falmouth High School fair