Harley-Davidson Has VROOOM to Grow

On Tuesday, Harley-Davidson Inc. (NYSE:HOG) beat analysts expectations in its fourth-quarter 2021 earnings results, reporting that it earned adjusted earnings per share of $0.15 in the fourth quarter as revenue jumped to $816.02 million with a net profit of $21.57 million. Analysts surveyed by FactSet had projected that the company would report a fourth-quarter loss of $0.34 per share on sales of $669 million.

Executives pointed to a rise in wholesale shipments, a favorable motorcycle unit mix and pricing in the U.S. market as reasons behind the exceptional results.

Results were strong for full fiscal 2021 overall, as motorcycle and related products revenue grew to $4.54 billion, while adjusted earnings were $4.21 per share.

Consolidated revenues were up 40% for the quarter at $1.02 billion, and increased 32% in 2021 to $5.3 billion, according to the release. Fourth-quarter gross margins for motorcycles dropped two percentage points. Stronger unit sales and pricing were offset by supply-chain headwinds and higher additional tariffs in the European Union, the company noted.

Motorcycle revenue alone rose 71% to $546 million in the fourth quarter. Parts and accessories, general merchandise and licensing also increased. Motorcycle shipments rose by 39% to $29.1 million. Retail motorcycle sales increased by 8% in North America during the fourth quarter to 8,855, but dipped across EMEA, Asia Pacific and Latin America.

Revenue growth was attributed to increased shipments and favorable motorcycle unit mix resulting from the companys Hardwire Strategy. Harley-Davidson recorded a 9.0% GAAP operating margin for the Motorcycles and Related Products segment (HDMC), which was well ahead of prior year and 2.7 percentage points ahead of 2019. It also achieved record Financial Services segment (HDFS) operating income of $415 million, up 112%, driven by lower provision for credit losses and lower interest expense.

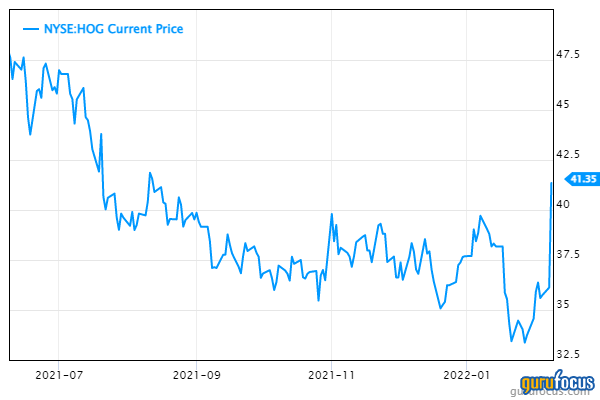

The companys stock was trading at $40.86 per share shortly before noon on Tuesday, a gain of 13.12%, or $4.74, following the positive news.

"Harley-Davidson delivered a strong finish to the year, in which we have seen proof points on all elements of our Hardwire Strategy," said Jochen Zeitz, Chairman, President and CEO of Harley-Davidson, in a statement. "Looking ahead, we are fully committed to achieving our long-term Hardwire Strategy, as the most desirable motorcycle brand and company in the world."

Management unveiled its five-year Hardwire strategic plan a year ago, which targets long-term profitable growth and shareholder value and aims to enhance its position as the most desirable motorcycle brand in the world. Highlights of the plan include targeting increased profitability and low double-digit EPS growth through 2025; broadening the view of its customers, inclusive of non-riders; and tailoring each step of the journey in new ways and through multiple channels, including enhanced digital touchpoints.

The plan also calls for investing in core segments of Touring, Large Cruiser and Trike to strengthen and grow its position, expanding into Adventure Touring and within the Cruiser segment to unlock untapped volume and margins and launching Harley-Davidson Certified, a pre-owned motorcycle program supporting growth expected across all complementary businesses.

For 2022, the company said it expects to achieve revenue growth of 5% to 10% and an operating income margin of 11% to 12%. It expects HDFS operating income to decline by 20% to 25%, and capital investments are projected to be $190 million to $220 million. The outlook assumes that supply chain challenges improve in the second half of the year, management added. The company's cash allocation priorities are to fund growth through The Hardwire initiatives, pay dividends, and execute discretionary share repurchases.

This article first appeared on GuruFocus.