Harpoon Therapeutics'(NASDAQ:HARP) Share Price Is Down 13% Over The Past Year.

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Harpoon Therapeutics, Inc. (NASDAQ:HARP) shareholders over the last year, as the share price declined 13%. That contrasts poorly with the market return of 47%. Harpoon Therapeutics may have better days ahead, of course; we've only looked at a one year period. The share price has dropped 25% in three months.

See our latest analysis for Harpoon Therapeutics

Harpoon Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Harpoon Therapeutics saw its revenue grow by 189%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 13% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

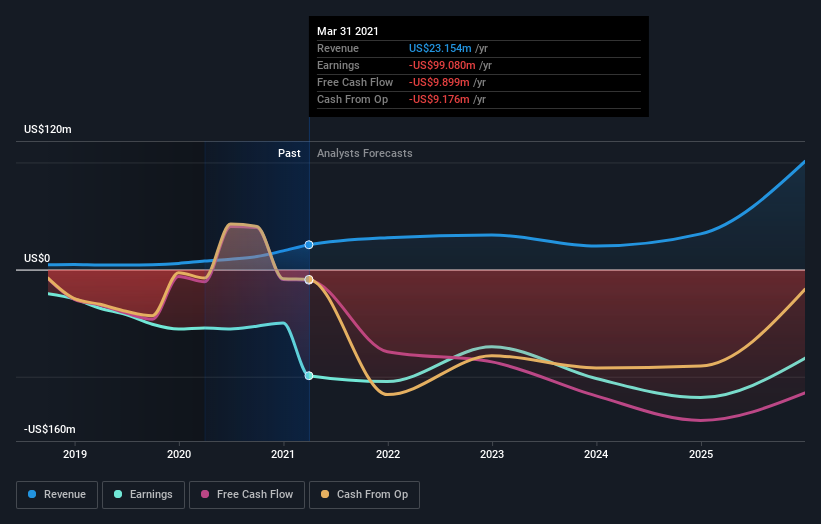

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Harpoon Therapeutics in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 47% in the last year, Harpoon Therapeutics shareholders might be miffed that they lost 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Notably, the loss over the last year isn't as bad as the 25% drop in the last three months. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. It's always interesting to track share price performance over the longer term. But to understand Harpoon Therapeutics better, we need to consider many other factors. Take risks, for example - Harpoon Therapeutics has 4 warning signs (and 1 which is a bit concerning) we think you should know about.

Harpoon Therapeutics is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.