Harris Ranch homeowners lost a key battle against special taxes. Now they’re trying this

A group of taxpayers in Boise’s Harris Ranch community has stepped up its fight against a special taxing district it says is unlawful and unfair.

The group, the Harris Ranch CID Taxpayers’ Association, appealed the Idaho Supreme Court on Sept. 6 after an Ada County judge ruled against it in April.

The legal battle centers on an October 2021 approval of $5 million in bonds, $10 million in extra property taxes and $7 million in additional payments to the developer of Harris Ranch, a master-planned community in the Barber Valley. The $22 million was approved by the board of the taxing district, which at the time was made up of Boise City Council members Elaine Clegg, TJ Thomson and Holli Woodings.

The board comprises council members Patrick Bageant, Latonia Haney Keith and Meredith Stead.

Homeowners within the taxing district, the Harris Ranch Community Infrastructure District, pay the taxes for infrastructure improvements the developer installs such as roads, parks and roundabouts.

Two of those homeowners, Larry Crowley and Bill Doyle, argue that the district is unlawful and should be scrapped. Crowley and Doyle serve as the association’s president and vice president, respectively.

An uncommon tool

This is the first time anyone has brought a community infrastructure district to the Idaho Supreme Court.

Community infrastructure districts, or CIDs, are still a relatively new and unused tool for development. The Idaho Legislature legalized them in 2008 to help growth pay for itself through higher taxes on those who live within district boundaries.

With homeowners in these districts paying more for local infrastructure improvements, it lessens the load on taxpayers outside the district. For instance, instead of taxpayers in the Bench or West Boise paying higher taxes on new sewers for Harris Ranch, more of this burden is shifted to the people actually using the new developments.

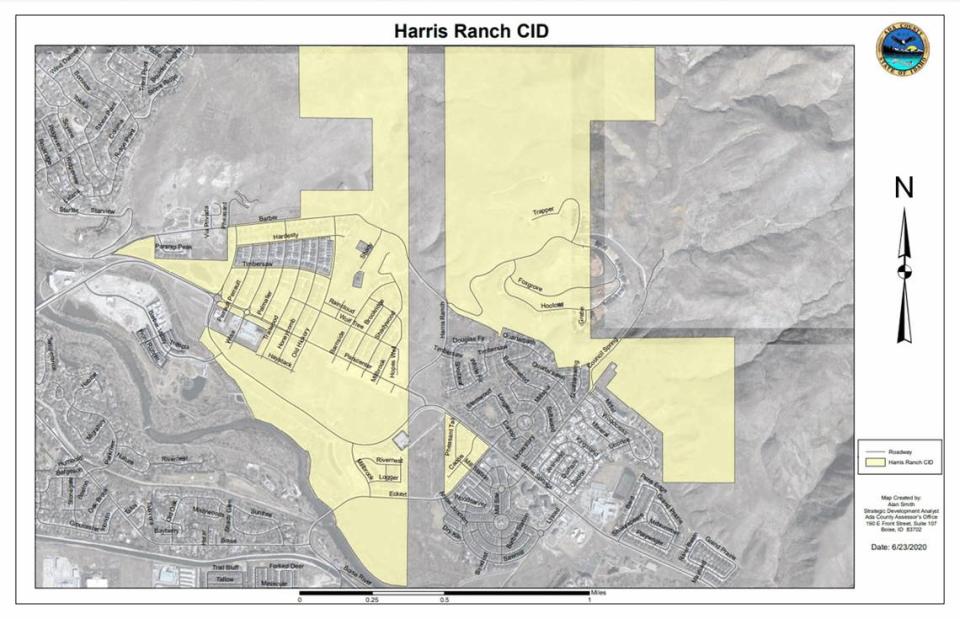

But homeowners within the Harris Ranch CID boundaries say they pay 40% higher taxes than those outside the district despite the district map cutting out several areas of the neighborhood. “(40%) is pretty much the average for everybody in the CID,” Crowley told the Idaho Statesman by phone.

The president of Barber Valley Development, Doug Fowler, previously said the district’s map was drawn without the existing homes because the developers believed the owners would reject a tax increase, according to prior Statesman reporting.

The money gathered from the CID has helped pay for the Harris Ranch Fire Station, Boise Greenbelt improvements, a sediment basin, the Warm Springs Avenue Bypass and the roundabout on East Park Center Boulevard.

As the legal battle unfolds, Fowler said it has affected development on the town center and Alta Harris Park.

“The litigation has definitely caused the development to pause in a couple of areas,” Fowler told the Statesman by phone.

Fowler said the costs to fight the lawsuit will add to the homeowners’ payments.

“We believe the Supreme Court will uphold the legislation that was passed some 15 years ago,” Fowler said.

Harris Ranch was the first community to test this new system, creating the CID in 2010 with only three votes cast, two of them from the businesses that sought the law: Barber Valley Development and Harris Family Limited Partnership. The law granted votes to businesses that own land in a proposed district. The third vote came from a farmhand.

Since then, Idaho has gained two more CIDs for the Avimor and Spring Valley communities. Spring Valley is now known as Valnova.

Judicial review denied

Crowley, Doyle and the association first took the taxing district, its board and Harris Family Limited Partnership to court in 2022. They alleged in their petition for judicial review that the district is flawed because of how it was formed, the noncontiguity of its map, and the requirement that only taxpayers in the district pay taxes for features that are also used by those outside the district.

The taxpayers had asked the court to find that the October 2021 actions approved by the CID board “were and are unlawful, invalid and void,” according to prior Statesman reporting.

Crowley said the two votes from the developers and one from a farmhand should be disqualified and shouldn’t count under Idaho law.

Despite this, Ada County 4th District Judge Nancy Baskin shot down one of their main arguments early on: how the district was formed.

“The development agreement, the election, all of those events are not part of this petition for judicial review,” Baskin said during a May 2022 hearing.

Baskin argued that the taxpayers could challenge the CID’s decisions within a 60-day period allowed by law, but not the years-earlier formation of the district.

A new question

Crowley, in an email, said Baskin shut down many of the association’s claims based on procedural grounds rather than the merits of the claims. He said Baskin acknowledged that many of the association’s issues were “close calls” that had never been litigated before.

According to Crowley, the association needs to win a single challenge to invalidate most, if not all, of the $22 million approved by the CID Board in October 2021.

Should growth pay for itself? Why tax district claiming to do that angers some Boiseans

Harris Ranch taxpayers take their fight against special tax district to new battlefield

Homeowners want special Boise tax district abolished. Judge casts doubt on key argument

Boise homeowners went to court to try to void a tax district. See what a judge decided