Healey unveils tax aid package with credits aimed to benefit residents in variety of ways

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

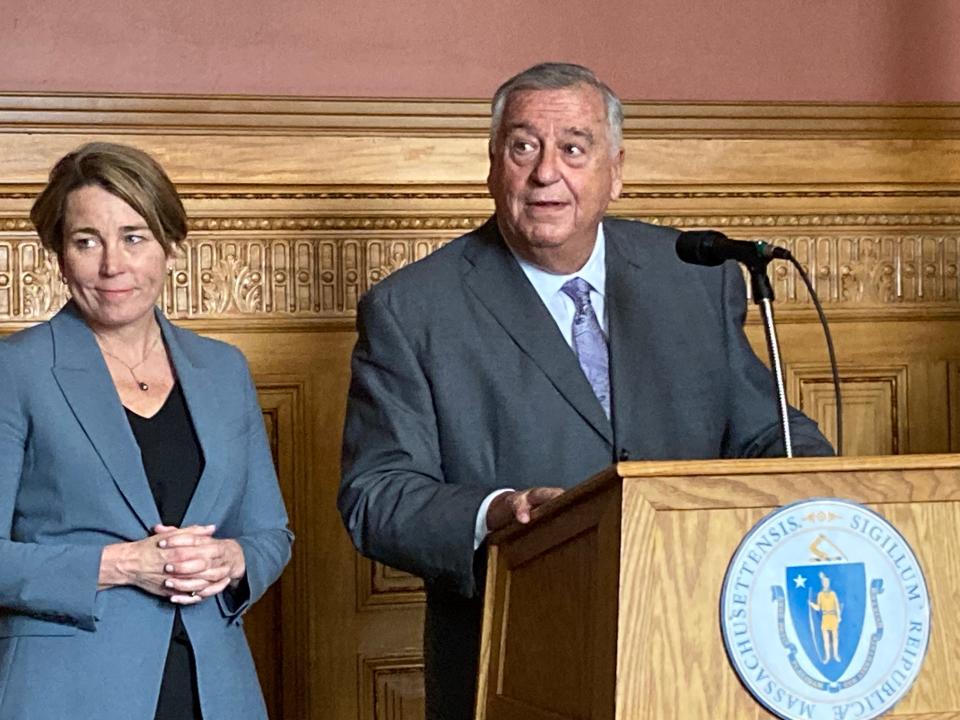

BOSTON — Gov. Maura Healey appears to be on the way to fulfilling her oft-repeated campaign promise of making the state more affordable for residents with a proposed $742 million tax relief package announced Monday at the Statehouse.

The package, which still must be passed by state legislators, offers relief for families with dependent children and family members, and offers tax relief to both renters and senior citizens while it eliminates inheritance tax on estates worth less than $3 million.

The package also proposes lowering taxes on short-term capital gains from 12% to 5%. The proposal comes in at $859 million with a net cost to the budget of $742 million.

Certain measures including relief for families with dependent children and senior citizens, are substantially the same as the package proposed by the Senate last summer. That package was scrapped after former Gov. Charlie Baker announced that the overage in taxes collected in 2021, as per the 1986 law Chapter 62F, mandated the return of almost $3 billion to residents filing income tax returns for 2021.

Estate taxes on inheritances would kick in at $3M

One major difference in the two packages is the cap on inheritance tax; last year's Senate package kicked in at estates valued above $2 million. The Healey package suggested taxing estates valued at $3 million or more.

In addressing some concerns with the cut in certain taxes, the governor said her package embraced concerns about "affordability, competitiveness and equity," and to promote the health and well-being of Massachusetts residents. In the package, Healey addressed the needs of the most vulnerable residents first while addressing some business community issues.

"I did not want Massachusetts to be an outlier," Healey said, explaining that it is one of only 12 states that impose an estate tax. Cutting the short-term capital gains tax by 7%, from 12% to 5%, is a way to attract and retain families; a way to grow business.

In the statement supporting the package, the administration indicated that about 70% of estates in Massachusetts are valued at less than $3 million; Healey’s proposal would ensure that those inheriting smaller holdings would not be taxed. Under the proposal, the $3 million ceiling will allow families to benefit from the sale of the family home without facing an onerous tax burden.

The package, which factors in record tax collection over the past few years and billions in state surplus, proposes a $600 dependent tax credit for families with no cap on the number of dependents claimed. The dependents could include children, disabled adults and senior citizens. There would be no income restrictions on the tax credit nor would there be paperwork requiring proof of eligibility.

House Speaker Ronald Mariano, D-Quincy, said his team will dive into the proposal to find areas of agreement.

"There are good things we have supported in the past and things that are new to us," Mariano said. Of immediate concern is the proposed cut to the state's short-term capital gains tax.

The remaining question, for Mariano, is how will the three budgets, the governor's and the budgets prepared by each branch of the Legislature, fit together.

Senate President Karen Spilka, D-Ashland, noted the similarities in the Healey tax relief proposal and the Senate package proposed last summer. She noted the best way to boost the economy is by getting funds directly into people's pockets.

Those funds, Spilka said, are then pumped straight back into the local economy when residents purchase food, clothing and entertainment.

“Having consistently stated my support for permanent progressive tax relief, I am excited to see Governor Healey’s proposal to provide much-needed financial relief to Massachusetts residents," Spilka said. "While the Senate will need time to dive into the details, I am particularly pleased to see support for families, parents with child care needs, seniors and persons with disabilities reflected in this proposal.

“With affordability a top concern on everyone’s minds, I look forward to continuing this conversation with my Senate colleagues and partners in the Administration and the House so that we can move forward with tax relief soon this session.”

Increased deductions for rent payments proposed

The governor's proposed package would increase the cap on allowable rent deduction by $1,000. Under the proposal, renters would be allowed to deduct $4,000 a year. The administration calculates some 800,000 renters would benefit from the new, higher cap.

However the median rental in Massachusetts has been calculated to be $3,150 a month by real estate giant Zillow, about $1,025 more than the national average. According to Zillow, Boston and the surrounding metropolitan area, is the nation’s second-most expensive housing market, following only New York City.

Massachusetts senior citizens also benefit under the proposed package. The tax proposal doubles how much senior residents over 65 can deduct through the Senior Circuit Breaker program. That tax benefit allows both homeowners and renters to deduct a portion of their housing costs based on property tax rates as compared to their income. There are income restrictions to the benefit.

Under Healey’s proposal, qualified senior citizens could see a maximum deduction of $2,400.

Mass. grassroots organizations praise, pan aspects of proposal

The tax package elicited both praise and criticism from two tax-centric entities, the Massachusetts Taxpayers Foundation and the Rise Up Massachusetts coalition.

While Rise Up Massachusetts, a coalition of more than 100 community organizations, praised Healey’s attention to the state’s low- and middle-income working people — the dependent tax credits, credits for renters and for those repaying student loans — the group also expressed concern that proposed changes to inheritance/estate taxes and capital gains would only benefit the state’s richest residents.

The group, which orchestrated the passage of the Fair Share Amendment, known as the millionaire’s tax, last fall is concerned the cut in real estate and capital gains taxes would create a hole in future budgets.

In a written statement, the group expressed both its pleasure and pain at the governor’s proposal.

“We are pleased to see Governor Healey propose several tax policies that are targeted at low- and middle-income working people, in line with our goal of a fairer state tax system. However, we are deeply concerned that proposed changes to the estate tax and short-term capital gains tax rate would deliver an enormous windfall to the richest members of our society, while depriving the state of hundreds of millions of dollars in much-needed revenues.”

In addition the group urges state legislators to “consider the full impact of a billion-dollar permanent tax cut on critical state spending areas, both today and in the case of a recession.” The group urged lawmakers to “prioritize the aspects of the plan that will aid low-income families who need relief the most, while protecting overall state revenues that fund the critical programs working people depend on.”

Other beneficiaries: dairy farmers, cider producers, homeowners

In its release, the taxpayers foundation praised the governor’s package, calling it the right step to help Massachusetts retain and grow its population, jobs and investment.

“Significant tax relief is not only affordable, it is critical. The Healey-Driscoll administration’s package would ease the cost crunch that’s making it tough for Massachusetts to attract and retain families, seniors and employers,” said Doug Howgate, president of the Massachusetts Taxpayers Foundation. “We need to address the trends that are pricing out low- and middle-income residents and stop incentivizing higher earning residents and businesses to leave.”

In a release that explains the details of the tax package, the administration said some 700,000 Massachusetts residents supporting more than 1 million dependents stand to benefit from the proposed $600 child and family credit. Healey hopes the credits, paid directly to families, will have the secondary effect of helping to alleviate child care costs.

Housing issues were also addressed, including the Housing Development Incentive Program. The program allows up to $10 million a year in state tax credits to developers of market-rate housing in the state’s gateway cities for qualified project expenditures. Healey proposes to increase the statewide cap from $10 million to $50 million on a one-time basis and settle at $30 million a year thereafter.

Commuters can add new deductions

Other tax beneficiaries include apprenticeship programs, commuters, property owners, theatrical productions, dairy farmers and cider makers.

Residents repaying student loans and receiving contributions toward the debt from employers would not be taxed on those contributions. Commuters could deduct the cost of regional transit and bicycle sharing programs and under the proposal, property owners would receive lead paint abatement credits, septic tank repair tax credits and credits for decontaminating polluted sites, brownfields, to ready them for development.

Dairy farmers and apple growers would get relief. The tax credit cap for dairy farmers would climb to $8 million and cider producers would be allowed to increase the alcohol content in their products, up to 8.5%, while maintaining the tax rate for their beverages at the one for products with lower alcohol content.

Culturally, Massachusetts residents would also benefit, with the administration proposing to allow tax credits for a share of payroll, production and transportation costs incurred by live theater.

This article originally appeared on Telegram & Gazette: Tax credits worth $742 million proposed for Massachusetts earners by Gov. Maura Healey