Health Check: How Prudently Does Glory Flame Holdings (HKG:8059) Use Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Glory Flame Holdings Limited (HKG:8059) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Glory Flame Holdings

What Is Glory Flame Holdings's Net Debt?

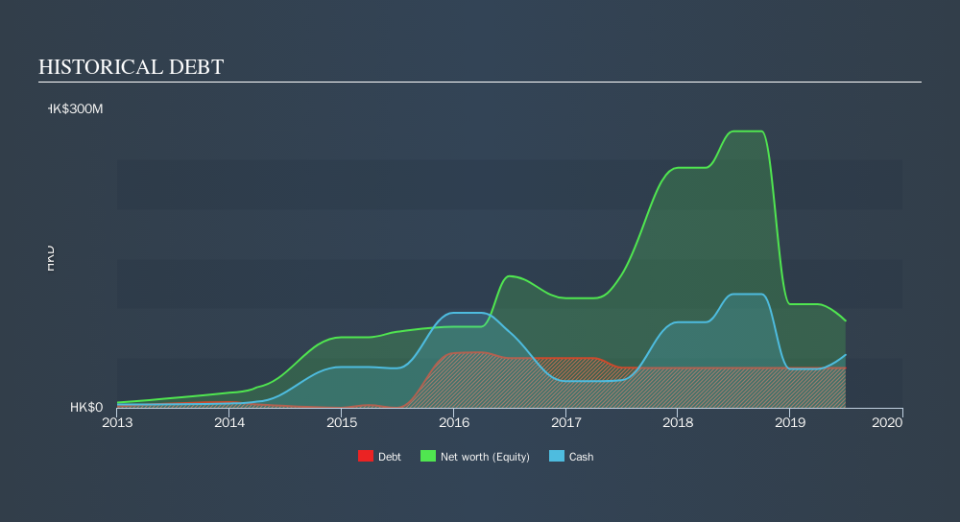

As you can see below, Glory Flame Holdings had HK$40.0m of debt, at June 2019, which is about the same the year before. You can click the chart for greater detail. However, it does have HK$53.3m in cash offsetting this, leading to net cash of HK$13.3m.

How Strong Is Glory Flame Holdings's Balance Sheet?

According to the last reported balance sheet, Glory Flame Holdings had liabilities of HK$64.3m due within 12 months, and liabilities of HK$12.5m due beyond 12 months. On the other hand, it had cash of HK$53.3m and HK$38.8m worth of receivables due within a year. So it can boast HK$15.3m more liquid assets than total liabilities.

This short term liquidity is a sign that Glory Flame Holdings could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Glory Flame Holdings has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Glory Flame Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Glory Flame Holdings made a loss at the EBIT level, and saw its revenue drop to HK$97m, which is a fall of 51%. That makes us nervous, to say the least.

So How Risky Is Glory Flame Holdings?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Glory Flame Holdings had negative earnings before interest and tax (EBIT), over the last year. And over the same period it saw negative free cash outflow of HK$6.2m and booked a HK$185m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of HK$13.3m. That kitty means the company can keep spending for growth for at least two years, at current rates. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Glory Flame Holdings insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.