Hearing over proposed tax credit weighs saving homeowners versus helping government

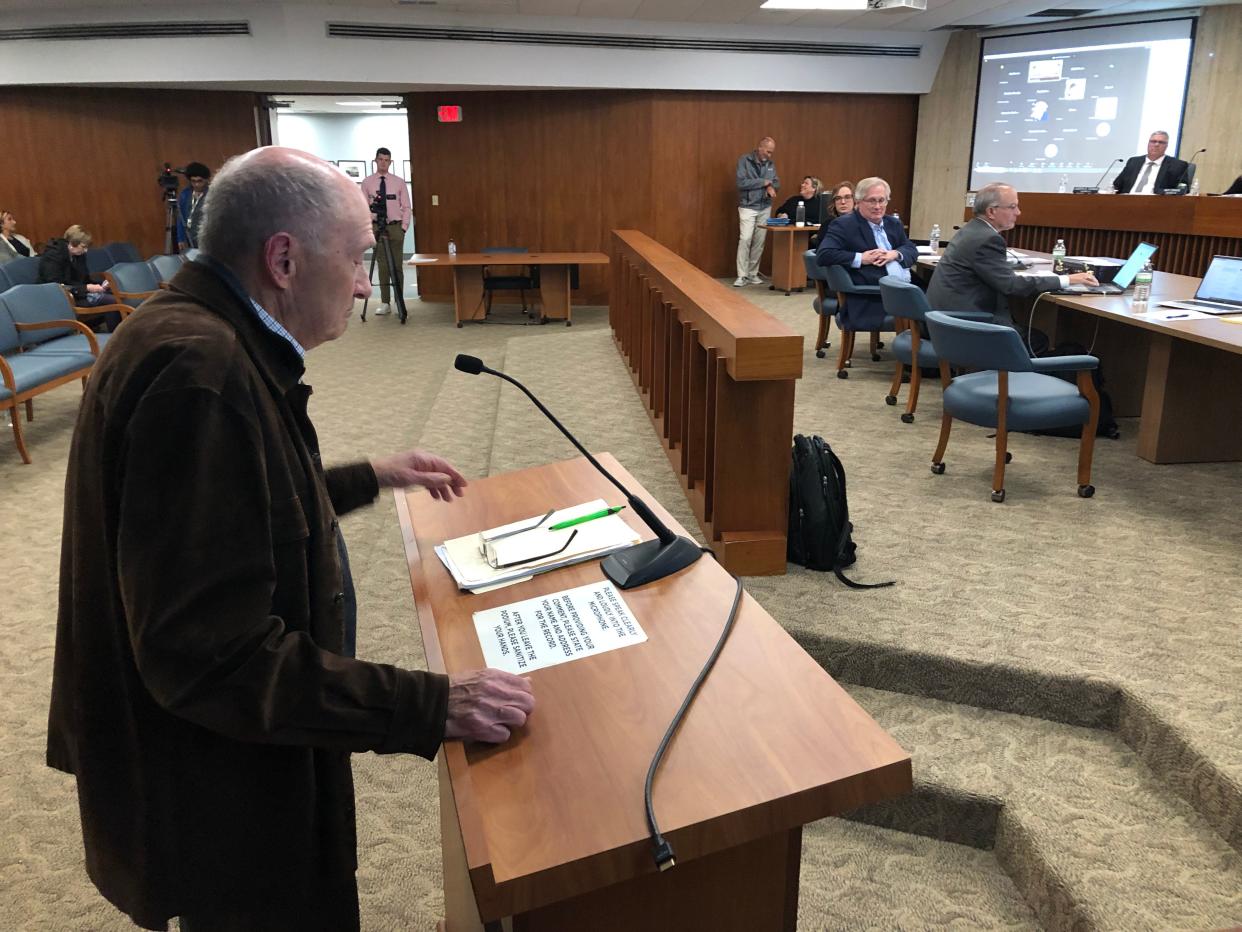

SOUTH BEND — Bryan Tanner applauds a proposed property tax credit for St. Joseph County homeowners age 55 and older and how it would soften the annual spikes in taxes.

But, after listening to his constituents, the county council member said Tuesday that he’s worried that too broad of a credit could siphon too much money from and hurt cities, schools and small townships that, he said, “often run on a shoestring.”

At the council’s public hearing Tuesday on the credit, fellow council member Amy Drake proposed an amendment to her original bill — the bill proposing the credit — that would limit the credit to homeowners with incomes of $75,000 or less for an individual and $150,000 or less for a married couple.

Tanner said those are more than five times the federal poverty level. He suggested going with median income limits of $45,000 for singles, $65,000 for married couples, which are still three times the poverty rate.

And when council President Mark Root asked if that posed a “marriage penalty,” Tanner said he’d accept a $90,000 limit for couples.

Oct. 3, 2023: Proposed credit for seniors in St. Joe County would limit property tax increases to 2%

Tanner’s real concern is for entities like the city of Mishawaka, where he was a former city councilman, and how public safety takes up a significant portion of its general fund. He questioned if the city’s lost income from the tax credit would equate to fewer full-time safety employees.

“We should value saving taxpayers, but to what detriment?” he said.

But Drake pointed out how the county passed along a lot of federal COVID aid to cities and townships, including for public safety. Now, she said, it’s time for taxpayers to get a break.

“The government has been well taken care of the past few years,” Drake said.

How the credit would work

The proposal will come back to the council for a vote at its Nov. 14 meeting. If passed, homeowners would be able to apply for the credit in 2024, and it would affect their bills in 2025. It would cap any increase in their property tax bill at no more than 2%. If last year’s bill was $2,000, for example, the most it could rise would be $40.

The credit is only for those with a homestead exemption. And, thanks to the new state law that made this credit possible, the credit would end after three years.

It essentially is for people from ages 55 to 65 because, per the new state law, you can’t also receive the state’s Over 65 Circuit Breaker Credit.

County consultant Steve Dalton has calculated that it could trim up to roughly $3.6 million from taxpayers’ bills per year, but he’s said the real loss would be lower because he didn’t factor in the income limits.

From those estimates, the city of Mishawaka could lose up to $267,000.

“We heard so many stories from taxpayers,” Root said, pointing to tax bills that sometimes jumped from $2,000 to $2,600 in a year. “This gives them a peace of mind. I think that’s the attraction, rather than saving hundreds of dollars.”

Council member Dan Schaetzle emphasized that Drake’s income limits would reach the “middle class” across the county.

Drake’s amendment with the tax limits passed 8-1, with council member Diana Hess voted against it. Tanner voted for the amendment but with the understanding that another amendment could be added at the November meeting.

Public input for and against

From the audience, Mark Piasecki of South Bend spoke in favor of the credit, recalling property tax seminars that the county hosted earlier this year and how homeowners came who struggled with tax increases.

“They kept asking, ‘What can I do?’” he said. “It’s not uncommon for people to be shocked by their bill. It disrupts their ability to plan.”

Piasecki also agreed with Drake’s proposed income limits, adding, “If we reduce them too much, I think the bill becomes not too effective.”

“I’m a middle class citizen,” Janet Johnson of South Bend said. “When I see my taxes go sky high, it really hurts. … I need to take care of my property and keep it looking good.”

But Cheri Brown of South Bend said she figured the credit may save her about $35 a year, which she equates to a half tank of gas.

“I’d rather contribute the money to public safety, to teachers,” she said, adding that property taxes are rising because property values are, too.

Steve Francis of Clay Township recalled how the council refused money for homeless efforts earlier in the year and then heard Drake talk Tuesday about extra money that went for public safety.

Francis said he doesn’t need the possible $100 in savings and would rather it go to needed services. Root then pointed out that homeowners do have that option. They don’t have to apply for the credit.

South Bend Tribune reporter Joseph Dits can be reached at 574-235-6158 or jdits@sbtinfo.com.

This article originally appeared on South Bend Tribune: County property tax credit hearing weighs homeowners and government