Here is What Hedge Funds Think About Arthur J. Gallagher & Co. (AJG)

Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors' money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

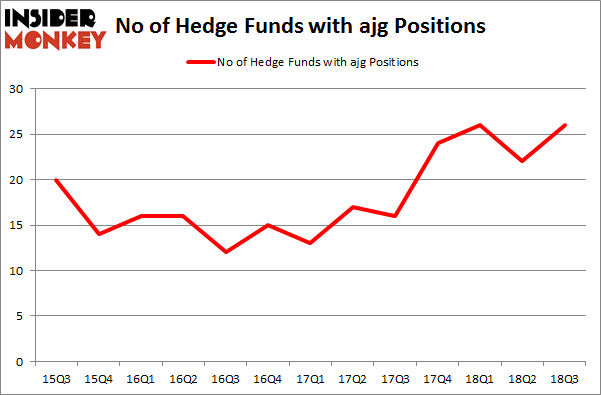

Is Arthur J. Gallagher & Co. (NYSE:AJG) ready to rally soon? The smart money is in a bullish mood. The number of bullish hedge fund bets moved up by 4 lately. Our calculations also showed that ajg isn't among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We're going to take a glance at the recent hedge fund action encompassing Arthur J. Gallagher & Co. (NYSE:AJG).

Hedge fund activity in Arthur J. Gallagher & Co. (NYSE:AJG)

At Q3's end, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in AJG over the last 13 quarters. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Viking Global held the most valuable stake in Arthur J. Gallagher & Co. (NYSE:AJG), which was worth $92 million at the end of the third quarter. On the second spot was Balyasny Asset Management which amassed $49.4 million worth of shares. Moreover, Millennium Management, Arrowstreet Capital, and Adage Capital Management were also bullish on Arthur J. Gallagher & Co. (NYSE:AJG), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds have jumped into Arthur J. Gallagher & Co. (NYSE:AJG) headfirst. Point72 Asset Management, managed by Steve Cohen, assembled the biggest position in Arthur J. Gallagher & Co. (NYSE:AJG). Point72 Asset Management had $25.8 million invested in the company at the end of the quarter. John Overdeck and David Siegel's Two Sigma Advisors also initiated a $2 million position during the quarter. The other funds with brand new AJG positions are Peter Seuss's Prana Capital Management, Benjamin A. Smith's Laurion Capital Management, and Ken Griffin's Citadel Investment Group.

Let's also examine hedge fund activity in other stocks - not necessarily in the same industry as Arthur J. Gallagher & Co. (NYSE:AJG) but similarly valued. We will take a look at TransUnion (NYSE:TRU), C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW), United Rentals, Inc. (NYSE:URI), and Eastman Chemical Company (NYSE:EMN). This group of stocks' market values resemble AJG's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position TRU,29,1758803,0 CHRW,28,457937,-2 URI,48,1131355,8 EMN,25,455394,-2 Average,32.5,950872,1 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.5 hedge funds with bullish positions and the average amount invested in these stocks was $951 million. That figure was $381 million in AJG's case. United Rentals, Inc. (NYSE:URI) is the most popular stock in this table. On the other hand Eastman Chemical Company (NYSE:EMN) is the least popular one with only 25 bullish hedge fund positions. Arthur J. Gallagher & Co. (NYSE:AJG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we'd rather spend our time researching stocks that hedge funds are piling on. In this regard URI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index