Here is What Hedge Funds Think About Evertec Inc (EVTC)

The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider Evertec Inc (NYSE:EVTC) for your portfolio? We'll look to this invaluable collective wisdom for the answer.

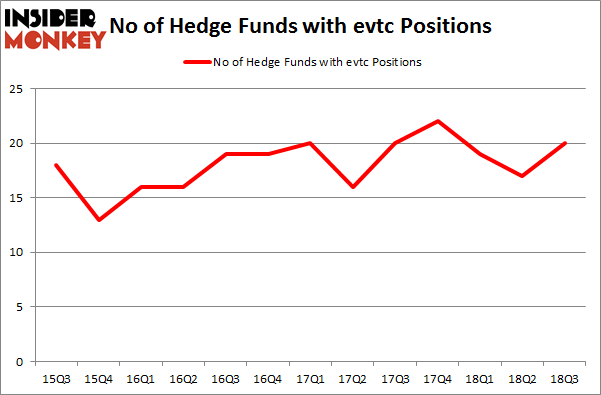

Is Evertec Inc (NYSE:EVTC) an excellent investment now? The best stock pickers are getting more bullish. The number of long hedge fund positions went up by 3 recently. Our calculations also showed that evtc isn't among the 30 most popular stocks among hedge funds. EVTC was in 20 hedge funds' portfolios at the end of the third quarter of 2018. There were 17 hedge funds in our database with EVTC positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let's check out the recent hedge fund action surrounding Evertec Inc (NYSE:EVTC).

How have hedgies been trading Evertec Inc (NYSE:EVTC)?

At the end of the third quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from the previous quarter. By comparison, 22 hedge funds held shares or bullish call options in EVTC heading into this year. So, let's check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Rivulet Capital held the most valuable stake in Evertec Inc (NYSE:EVTC), which was worth $44.8 million at the end of the third quarter. On the second spot was GLG Partners which amassed $38.7 million worth of shares. Moreover, Millennium Management, Renaissance Technologies, and Pzena Investment Management were also bullish on Evertec Inc (NYSE:EVTC), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names have jumped into Evertec Inc (NYSE:EVTC) headfirst. Leucadia National, managed by Ian Cumming and Joseph Steinberg, initiated the most outsized position in Evertec Inc (NYSE:EVTC). Leucadia National had $1.4 million invested in the company at the end of the quarter. Michael Platt and William Reeves's BlueCrest Capital Mgmt. also initiated a $0.6 million position during the quarter. The other funds with brand new EVTC positions are Brandon Haley's Holocene Advisors, Alec Litowitz and Ross Laser's Magnetar Capital, and Matthew Tewksbury's Stevens Capital Management.

Let's check out hedge fund activity in other stocks similar to Evertec Inc (NYSE:EVTC). These stocks are G1 Therapeutics, Inc. (NASDAQ:GTHX), LTC Properties Inc (NYSE:LTC), Helios Technologies (NASDAQ:SNHY), and Eagle Bancorp, Inc. (NASDAQ:EGBN). This group of stocks' market values match EVTC's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position GTHX,20,132411,7 LTC,9,19503,0 SNHY,8,155782,3 EGBN,19,77751,8 Average,14,96362,4.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $96 million. That figure was $194 million in EVTC's case. G1 Therapeutics, Inc. (NASDAQ:GTHX) is the most popular stock in this table. On the other hand Helios Technologies (NASDAQ:SNHY) is the least popular one with only 8 bullish hedge fund positions. Evertec Inc (NYSE:EVTC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. In this regard GTHX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index