Hennessy Japan Fund's Top 5 Buys in Fiscal 1st Quarter

The Hennessy Japan Fund (Trades, Portfolio), part of Novato, California-based Hennessy Advisors Inc. (NASDAQ:HNNA), disclosed this week that its top five buys during the quarter ending Jan. 31 included a new position in Sony Corp. (TSE:6758) and position boosts in Takeda Pharmaceutical Co. Ltd. (TSE:4502), Mitsubishi Corp (TSE:8058), Kao Corp. (TSE:4452) and MISUMI Group Inc. (TSE:9962).

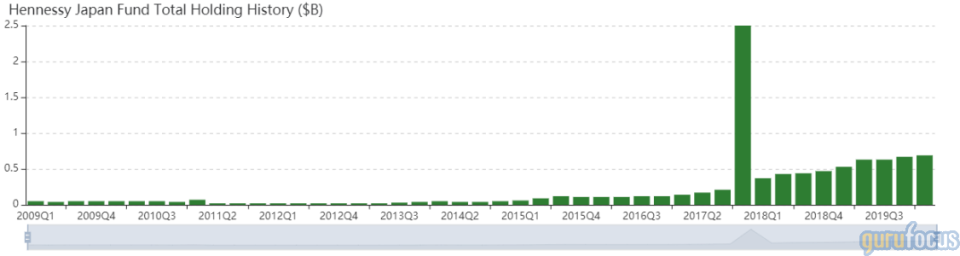

Managed by Masakazu Takeda and Yu Shimizu, the fund seeks long-term capital appreciation by investing over 80% of its assets into Japanese securities in which the fund managers believe are good businesses with strong company management and which are trading at attractive prices.

Fund managers update market situation as Covid-19 rattles markets

The fund shared in the "Insights" section of its website management commentary regarding the coronavirus outbreak, which as of Wednesday yielded over 885,000 cases worldwide according to data from John Hopkins University. The TOPIX and Nikkei Stock Average, two major Japanese equity indexes, tumbled 24.6% and 25.5% from Feb. 25 to March 13 as the coronavirus spread beyond China and Japan, worsened by declining crude oil prices due to a price wars among OPEC nations and Russia.

Despite the decline, a major shareholder encouraged the fund managers to stay optimistic and "carry on steadily with what [the managers] were planning to do." The managers concluded by saying that they will continue making bottom-up, selective investments consistent with their investment philosophy.

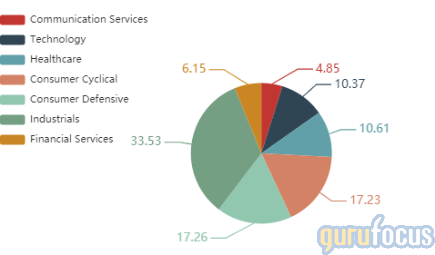

As of fiscal first quarter-end, the $688 million equity portfolio contains 24 stocks with a turnover ratio of 8%. The top three sectors in terms of weight are industrials, consumer staples and consumer discretionary, with weights of 33.53%, 17.26% and 17.23%.

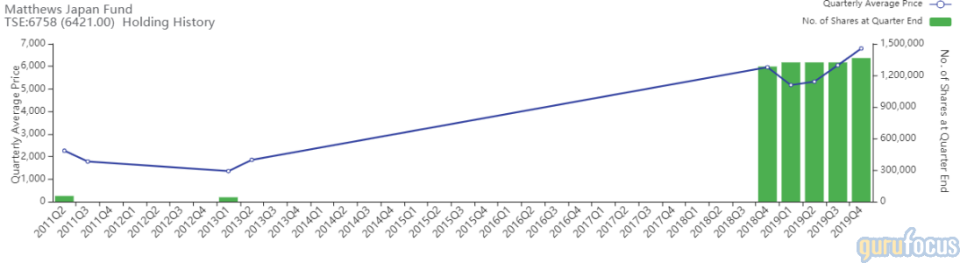

New buy: Sony

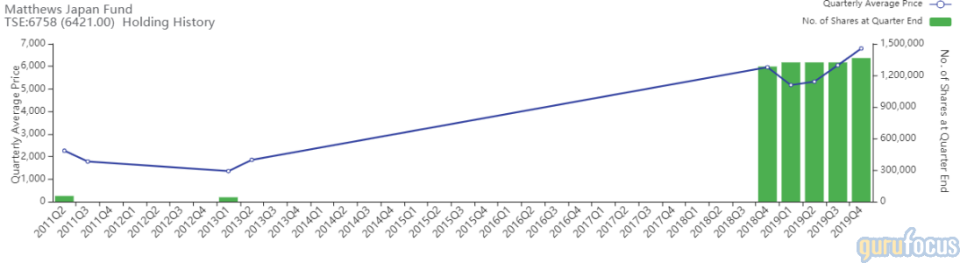

Keeping with their philosophy, the fund managers established a 510,200-share position in Sony during the quarter. The shares, which occupy 5.19% of the equity portfolio, averaged 7,294.91 yen ($68.09) during the quarter.

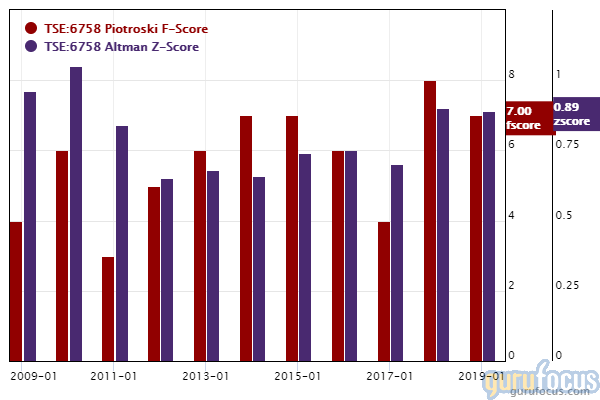

The Tokyo-based company manufactures a wide range of consumer electronics, including Walkman audio players, Cybershot digital cameras and PlayStation video consoles. GuruFocus ranks the company's financial strength 6 out of 10: Although the company's interest coverage outperforms over 78% of global competitors, Sony has a weak Altman Z-score of 0.92 and debt ratios that underperform over 61% of global hardware companies.

Other gurus with holdings in Sony include the Matthews Japan Fund (Trades, Portfolio) and Signature Select Canadian Equity Fund. Additionally, gurus with holdings in Sony's U.S.-based shares (NYSE:SNE) include Mario Gabelli (Trades, Portfolio) and Daniel Loeb (Trades, Portfolio).

Takeda Pharmaceutical

The fund added 278,600 shares of Takeda Pharmaceutical, increasing the position 44.36% and the equity portfolio 1.55%. Shares averaged 4,378.83 yen during the quarter.

Takeda manufactures pharmaceutical drugs for a wide range of medical areas, including oncology, gastroenterology and neuroscience. According to GuruFocus, Takeda's financial strength ranks 3 out of 10 on several weak signs, which include debt ratios that underperform over 85% of global competitors.

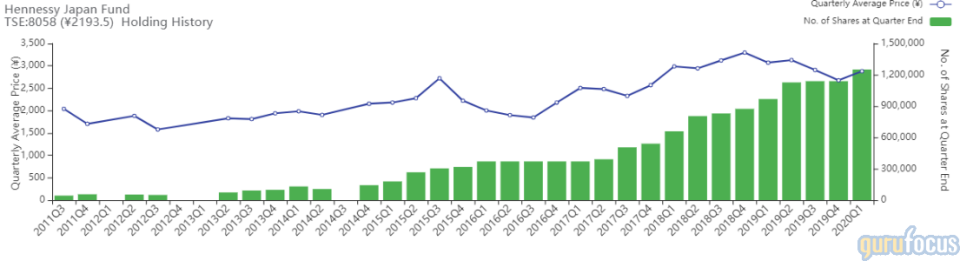

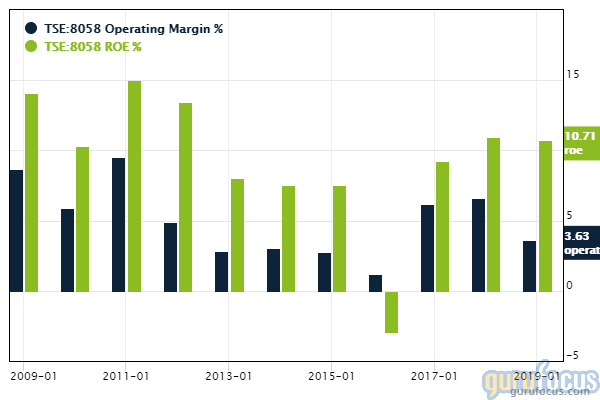

Mitsubishi

The fund added 111,500 shares of Mitsubishi, increasing the position 9.79% and the equity portfolio 0.42%. Shares averaged 2,881.27 yen during the quarter.

Mitsubishi offers products and services to a wide range of industries, including business services, industrial finance, energy and materials. GuruFocus ranks the company's profitability 7 out of 10 on several positive investing signs, which include expanding operating margins and returns that are outperforming over 70% of global competitors.

Kao

The fund added 35,700 shares of Kao, increasing the position 8.75% and the equity portfolio 0.41%. Shares averaged 8,855.84 yen ($82.63) during the quarter.

The Tokyo-based company produces beauty care products, human health care products and home care products. GuruFocus ranks Kao's profitability 8 out of 10 on several positive investing signs, which include expanding operating margins, a four-star business predictability rank and a return on equity that outperforms 84.41% of global competitors.

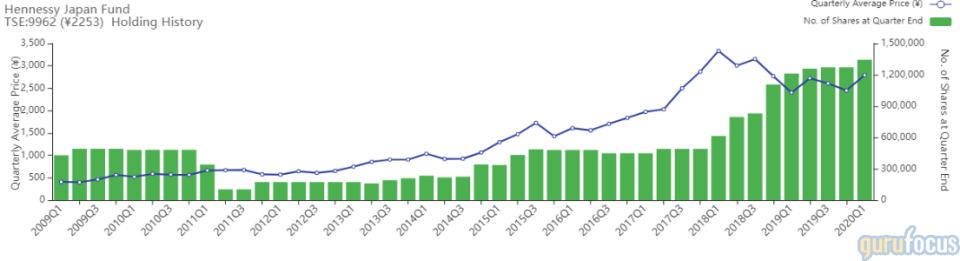

MISUMI

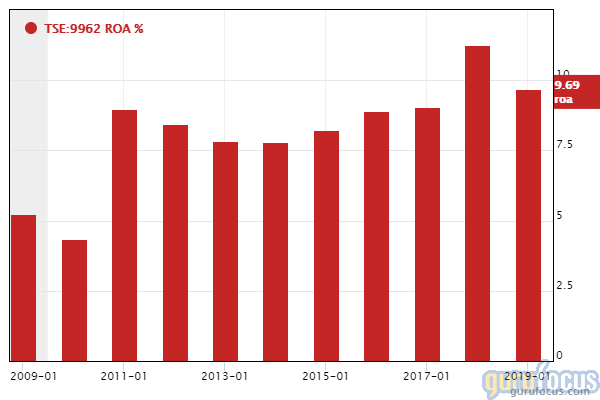

The fund added 72,400 shares of MISUMI, increasing the position 5.69% and the equity portfolio 0.26%. Shares averaged 2,792.66 yen during the quarter.

MISUMI manufactures components and parts used in automation processes. GuruFocus ranks the company's financial strength 10 out of 10 and profitability 9 out of 10 on several positive investing signs, which include robust interest coverage, a strong Altman Z-score of 11.58 and a return on assets that outperforms 83.50% of global competitors.

Disclosure: The author has no positions mentioned.

Read more here:

Mawer Canadian Equity Fund's Top 5 Buys in 2nd Half of 2019

5 Margin-Expanding Homebuilders to Build on in the 2nd Quarter

5 Japanese Leisure Companies to Consider as Tokyo Olympics Is Postponed

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.