Hennessy Japan Fund's Top 5 Buys in 3rd Quarter

The Hennessy Japan Fund (Trades, Portfolio) disclosed this week its top five buys included a new holding in Nitori Holdings Co. Ltd. (TSE:9843) and position boosts in four companies: Anicom Holdings Inc. (TSE:8715), Shimano Inc. (TSE:7309), Unicharm Corp. (TSE:8113) and Terumo Corp. (TSE:4543).

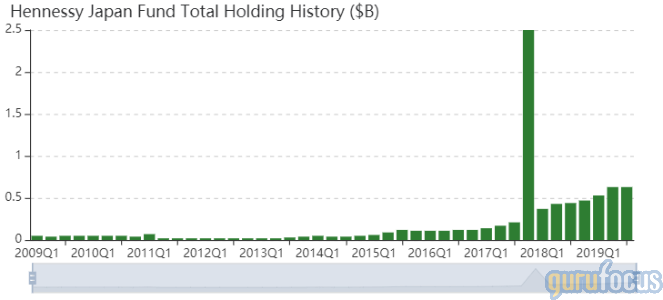

According to its website, the fund seeks high-quality, globally-oriented Japanese companies with time-tested business models and exceptional management teams that can perform well through economic cycles. The fund, which is part of Novato, California-based Hennessy Advisors Inc. (NASDAQ:HNNA), has 25 stocks in its $627 billion equity portfolio as of quarter-end.

Fund managers Masakazu Takeda and Yu Shimizu said in a September "portfolio perspectives" article that the market-moving news during the year to date included external events, including the U.S.-China trade war and the U.S. yield curve inversion. Despite the slowdown during the previous quarter, the fund managers mentioned the forward price-earnings ratio of the Tokyo Stock Price Index is 12.5, the second-lowest among the G-7 countries. GuruFocus reports, according to Warren Buffett (Trades, Portfolio)'s market indicator comparing the total market cap to gross domestic product, the expected future return of the Japanese market is 0.5%, including economic growth and dividends.

Nitori

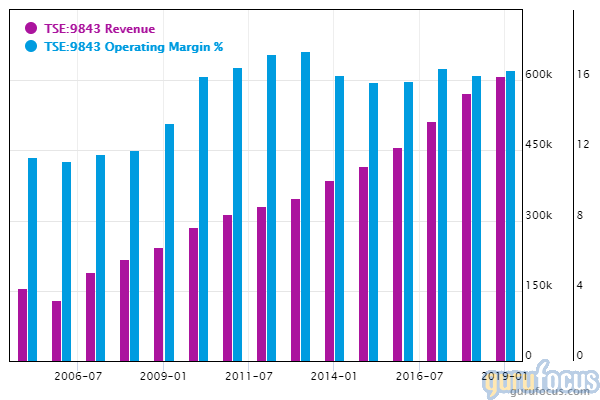

The fund purchased 174,300 shares of Nitori, giving the position 3.75% weight in the equity portfolio. Shares averaged 13,624.60 yen ($125.40) during the quarter.

Nitori sells furniture and interior goods through its home furnishing and fashion stores, along with other ventures, including the Nitori Mall and Corporate Enterprise. GuruFocus ranks the company's financial strength and profitability 9 out of 10 on several positive investing signs, which include robust interest coverage, debt ratios that outperform over 92% of global competitors and operating margins that have increased approximately 0.60% per year on average over the past five years. Despite this, Nitori has a weak Piotroski F-score of 2.

The Matthews Japan Fund (Trades, Portfolio) has not disclosed its third-quarter portfolio as the deadline to release portfolios, per Securities and Exchange Commission guidelines, is 45 days after the quarter ends. As of the second quarter, Matthews' Japan Fund owns 516,500 shares.

Anicom

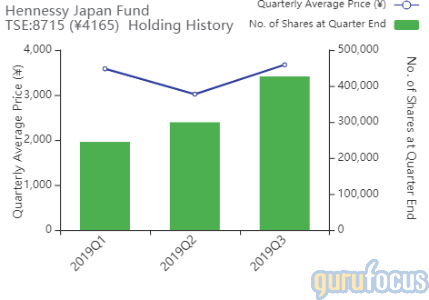

The Hennessy fund added 127,300 shares of Anicom, increasing the position 42.53% and the equity portfolio 0.71%. Shares averaged 3,672.73 yen during the quarter.

Anicom provides health insurance policies for pets and operates an insurance agency through the internet and personal visits. According to GuruFocus, Anicom has no long-term debt and a return on assets that outperforms 71.96% of global competitors.

Shimano

The fund added 20,000 shares of Shimano, increasing the holding 9.46% and the equity portfolio 0.45%. Shares averaged 16,213.30 yen during the quarter.

Shimano manufactures bicycle components and fishing tackle. GuruFocus ranks the company's financial strength 9 out of 10 on several positive investing signs, which include robust interest coverage, a strong Altman Z-score of 19.89 and debt ratios that outperform over 90% of global competitors.

Even though the company's revenue per share declined approximately 2.8% per year over the past three years, a rate that underperforms 72.17% of global recreation companies, GuruFocus still ranks Shimano's profitability 8 out of 10 on the heels of expanding profit margins and a return on assets that outperforms 87.44% of global peers.

Unicharm

The fund added 54,400 shares of Unicharm, increasing the position 5.67% and the equity portfolio 0.25%. Shares averaged 3,313.13 yen during the quarter.

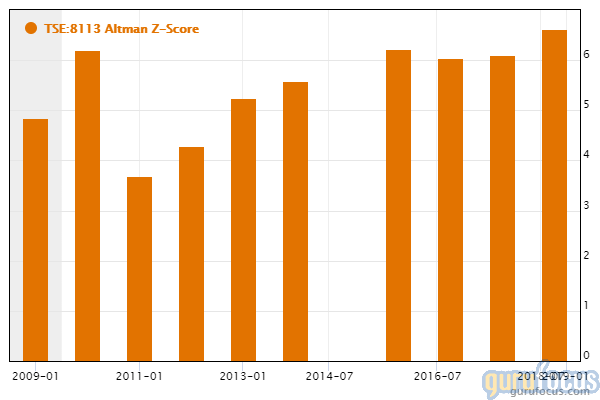

Unicharm manufactures disposable baby diapers, feminine sanitary products and adult incontinence care products. GuruFocus ranks the company's financial strength 8 out of 10 on several positive investing signs, which include a strong Altman Z-score of 6.48 and debt ratios that outperform over 84% of global competitors.

Terumo

The fund added 22,800 shares of Terumo, increasing the position 2.2% and the equity portfolio 0.11%. Shares averaged 3,176.16 yen during the quarter.

Terumo manufactures and sells medial products and equipment for three main businesses: blood management, cardiac and vascular and general hospital. GuruFocus ranks the company's financial strength 7 out of 10: Even though debt ratios underperform over 53% of global competitors, Terumo has strong interest coverage and Altman Z-scores.

Disclosure: No positions.

Read more here:

Invesco European Growth Fund Starts 1 Position, Boosts 5 Others in 3rd Quarter

Spiros Segalas' Top 5 Buys in the 3rd Quarter

Third Avenue Value Fund's Top 5 Buys in the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.