Hennessy Japan Small Cap Fund Adds 4 Stocks to Portfolio

The Hennessy Japan Small Cap Fund (Trades, Portfolio) disclosed four new positions when it released its second-quarter portfolio earlier this week.

Part of California-based Hennessy Advisors, the fund is managed by Tadahiro Fujimura and Tetsuya Hirano. Focusing on sustainable growth while limiting downside, the portfolio managers invest in a concentrated number of growth-oriented, small-cap Japanese companies that have a strong balance sheet, a durable competitive advantage, a high return on equity, above-average earnings growth and strong cash flow generation.

Adhering to these criteria, the fund established positions in AEON Financial Service Co. Ltd. (TSE:8570), Morita Holdings Corp. (TSE:6455), RORZE Corp. (TSE:6323) and Kanto Denka Kogyo Co. Ltd. (TSE:4047) during the three months ended April 30.

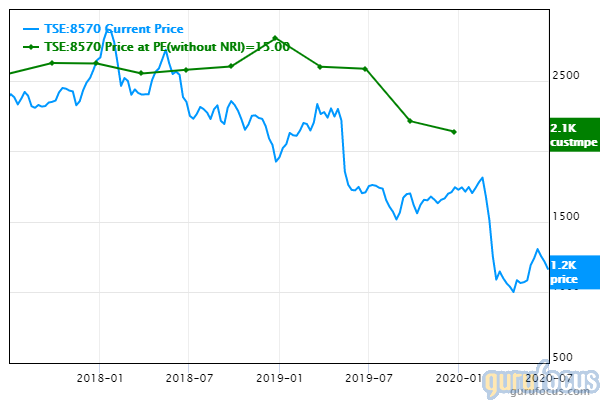

AEON Financial Service

Having previously sold out of a position in AEON Financial Service, the Small Cap Fund entered a new 70,000-share holding. The trade had an impact of 0.90% on the equity portfolio. The stock traded for an average price of 1,341.65 yen ($12.48) per share during the quarter.

The bank has a market cap of 250.98 billion yen; its shares closed at 1,163 yen on Wednesday with a price-earnings ratio of 8.16, a price-book ratio of 0.66 and a price-sales ratio of 0.61.

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued.

GuruFocus rated AEON Financial's financial strength 2 out of 10. While the cash-debt ratio of 0.82 is outperforming its competitors and compared to its history, the equity-to-asset and debt-to-equity ratios are underperforming.

The company's profitability fared better with a 5 out of 10 rating. Although AEON has recorded a decline in revenue per share over the past five years, it still has a predictability rank of one out of five stars. According to GuruFocus, companies with this rank typically return an average of 1.1% annually over a 10-year period.

The fund holds 0.03% of the company's outstanding shares.

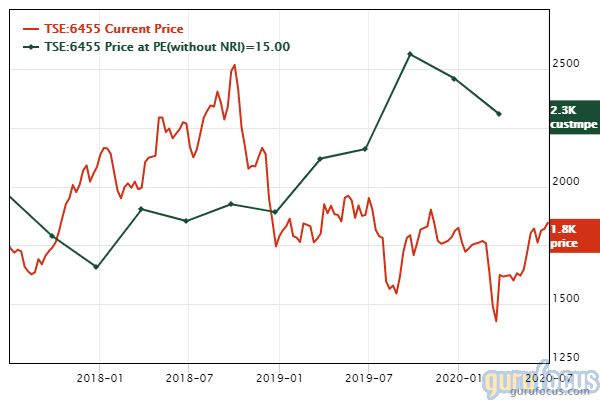

Morita Holdings

After selling out of a holding in the first quarter of 2013, the fund opened a new 38,900-share position in Morita Holdings, giving it 0.74% space in the equity portfolio. During the quarter, shares traded for an average price of 1,641.45 yen each.

The company, which manufactures fire trucks, emergency supplies, industrial machinery and environmental vehicles, has a market cap of 81.73 billion yen; its shares closed at 1,803 yen on Wednesday with a price-earnings ratio of 11.73, a price-book ratio of 1.17 and a price-sales ratio of 0.95.

According to the Peter Lynch chart, the stock is undervalued. The GuruFocus valuation rank of 3 out of 10, however, leans more toward overvalued territory since its share price and price-sales ratio are near one-year highs.

Morita Holdings' financial strength was rated 7 out of 10 by GuruFocus, driven by comfortable interest coverage and a high Altman Z-Score of 3.31 that indicates it is in good standing despite recording a decline in revenue per share over the past year. Its cash-debt ratio of 1.98 is also performing better than over half of its competitors and versus its history.

The company's profitability scored an 8 out of 10 rating. Although its margins are in decline, they still outperform a majority of industry peers. Morita also has strong returns, a moderate Piotroski F-Score of 6, which indicates operations are stable, and a 4.5-star predictability rank. GuruFocus says companies with this rank typically see their stocks gain an average of 10.6% annually.

The Small Cap Fund holds 0.09% of the company's outstanding shares.

RORZE

Hennessy invested in 12,700 shares of RORZE, dedicating 0.64% of the equity portfolio to the holding. The stock traded for an average per-share price of 3,623.08 yen during the quarter.

The company, which manufactures automation systems for semiconductor production, has a market cap of 93.84 billion yen; its shares closed at 5,430 yen on Wednesday with a price-earnings ratio of 17.16, a price-book ratio of 3.74 and a price-sales ratio of 2.49.

Based on the Peter Lynch chart, the stock appears to be overvalued.

RORZE's financial strength and profitability were both rated 7 out of 10 by GuruFocus. The company is not only supported by sufficient interest coverage, but a robust Altman Z-Score of 4.2 as well.

The company also has an expanding operating margin, strong returns that outperform a majority of competitors and a one-star predictability rank. Its low Piotroski F-Score of 3 indicates business conditions are in poor shape, though.

The fund holds 0.07% of RORZE's outstanding shares.

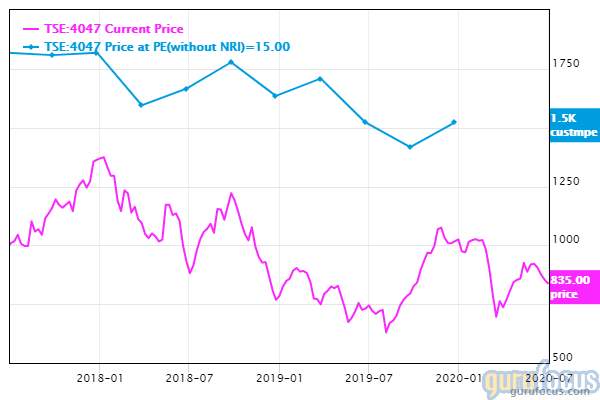

Kanto Denka Kogyo

The Japan Small Cap Fund picked up 55,700 shares of Kanto Denka Kogyo, allocating 0.55% of the equity portfolio to the position. The stock traded for an average price of 864.55 yen per share during the quarter. It previously sold out of a holding in the third quarter of 2012.

The chemical company, which also manufactures specialty gas and battery materials, has a market cap of 48.03 billion yen; its shares closed at 835 yen on Wednesday with a price-earnings ratio of 8.22, a price-book ratio of 1.05 and a price-sales ratio of 0.86.

The Peter Lynch chart suggests the stock is undervalued.

Kanto Denka Kogyo's financial strength and profitability were both rated 7 out of 10 by GuruFocus. While the company has adequate interest coverage, the Altman Z-Score of 2.87 indicates it is under some pressure since its assets are building up at a faster rate than revenue is growing.

The company is also being supported by an expanding operating margin and solid returns that outperform a majority of industry peers. Kanto Denka Kogyo has a low Piotroski F-Score of 3, however, and, as a result of slowing revenue per share growth over the past year, its one-star predictability rank is on watch.

The fund holds 0.10% of the company's outstanding shares.

Additional trades and portfolio performance

Other major trades of the quarter included the divestment of NS Solutions Corp. (TSE:2327), Kasai Kogyo Co. Ltd. (TSE:7256), Hoshizaki Corp. (TSE:6465), Parco Co. Ltd. (TSE:8251), DCM Holdings Co. Ltd. (TSE:3050) and Studio Atao Co. Ltd. (TSE:3550), along with a number of additions and reductions.

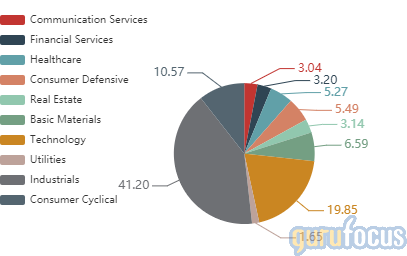

Hennessy's $81 million equity portfolio, which is composed of 58 stocks, is mostly heavily invested in the industrials sector with a weight of 41.2%.

According to its website, the Japan Small Cap Fund returned 19.95% in 2019, eclipsing both the Russell/Nomura Small Cap Index's 18.34% return and the Tokyo Stock Price Index's return of 19.67%.

Disclosure: No positions.

Read more here:

Third Avenue Value Fund Buys 3 Stocks, Sells 1 in 2nd Quarter

3 Health Care Companies That Beat the Market in the 1st Half of the Year

Gunmakers Are Thriving Despite Market Turmoil, Pending Remington Bankruptcy

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.