Here's How Carter's (CRI) Looks Just Ahead of Q3 Earnings

- Oops!Something went wrong.Please try again later.

Carter's, Inc. CRI is likely to register a decrease in the top line when it reports third-quarter 2020 numbers on Oct 23, before the market opens. The Zacks Consensus Estimate for revenues is pegged at $882.2 million, suggesting a decline of about 6.5% from the prior-year reported figure.

Nonetheless, we note that the rate of sales decline is likely to decelerate sharply on a sequential basis. The company had witnessed a decline of 29.9% in the last-reported quarter, when stores were closed in the wake of coronavirus, particularly during the months of April and May. Also, lower sales to certain wholesale customers owing to COVID-19-related disruptions hurt the top line in the preceding quarter.

Further, the bottom line is expected to decline year over year. We note that the Zacks Consensus Estimate for third-quarter earnings has remained stable at $1.67 over the past 30 days. The consensus estimate suggests a decline of 10.7% from earnings of $1.87 reported in the year-ago period.

Notably, this largest branded marketer in North America of apparel exclusively for babies and young children has outperformed the Zacks Consensus Estimate by a wide margin in the last reported quarter.

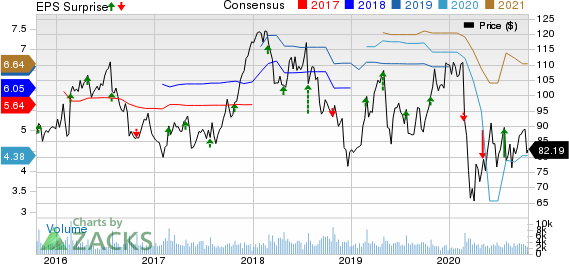

Carter's, Inc. Price, Consensus and EPS Surprise

Carters, Inc. price-consensus-eps-surprise-chart | Carters, Inc. Quote

Factors to Note

Despite the reopening of stores, the impact of coronavirus on Carter's third-quarter performance cannot be ignored. On its last earnings call, management informed that it expects COVID-19 will continue to have a significant impact on operations in the second half. The company on its call also highlighted about soft start to back-to-school outfitting on account of delay in school re-openings and sluggish demand from international guests and tourists owing to the resurgence of the coronavirus cases in Florida, Texas and California.

Also, any softness in wholesale channel due to lower sales to wholesale customers on account of curtailment in inventory commitments due to the pandemic, might get reflected in the to-be-reported quarter’s top line.

Nonetheless, Carter's focus on enhancing marketing activities, improving omni-channel and e-commerce capabilities and optimizing cost structure are likely to have favorably impacted the quarter. We note that the company has been gaining from rising demand for its products online, which might have boosted e-commerce sales in the third quarter. The company’s results are likely to have benefited from its same-day pickup service for online orders and easy access to its credit card program. We believe that online demand for baby, sleepwear and playwear product offerings are likely to have been high. Moreover, the company is likely to have gained from increasing demand for facemasks for children.

Apart from these, operating expenses related to e-commerce, such as fulfillment costs will be an area to watch.

What the Zacks Model Unveils

Our proven model does not conclusively predict a beat for Carter's this earnings season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Carter's has a Zacks Rank #3 but an Earnings ESP of 0.00%.

Stocks With a Favorable Combination

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

Wolverine World Wide WWW has an Earnings ESP of +17.86% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gap GPS has an Earnings ESP of +16.70% and a Zacks Rank #3.

Steven Madden SHOO has an Earnings ESP of +5.42% and a Zacks Rank #3.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

Carters, Inc. (CRI) : Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research