Here's How We Evaluate American Water Works Company, Inc.'s (NYSE:AWK) Dividend

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Is American Water Works Company, Inc. (NYSE:AWK) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

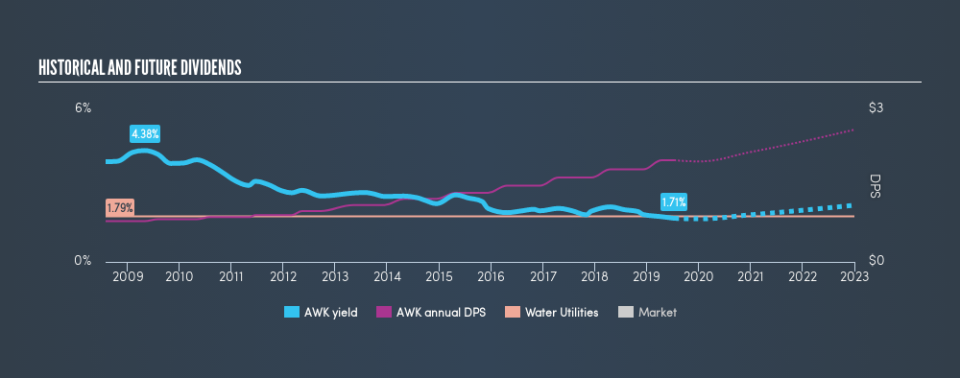

While American Water Works Company's 1.7% dividend yield is not the highest, we think its lengthy payment history is quite interesting. Some simple analysis can reduce the risk of holding American Water Works Company for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on American Water Works Company!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. American Water Works Company paid out 57% of its profit as dividends, over the trailing twelve month period. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Unfortunately, while American Water Works Company pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

Is American Water Works Company's Balance Sheet Risky?

As American Water Works Company has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. With net debt of 5.12 times its EBITDA, American Water Works Company could be described as a highly leveraged company. While some companies can handle this level of leverage, we'd be concerned about the dividend sustainability if there was any risk of an earnings downturn.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. With EBIT of 3.23 times its interest expense, American Water Works Company's interest cover is starting to look a bit thin. High debt and weak interest cover are not a great combo, and we would be cautious of relying on this company's dividend while these metrics persist.

Remember, you can always get a snapshot of American Water Works Company's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of American Water Works Company's dividend payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past ten-year period, the first annual payment was US$0.80 in 2009, compared to US$2.00 last year. This works out to be a compound annual growth rate (CAGR) of approximately 9.6% a year over that time.

Companies like this, growing their dividend at a decent rate, can be very valuable over the long term, if the rate of growth can be maintained.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Earnings have grown at around 8.8% a year for the past five years, which is better than seeing them shrink! The rate at which earnings have grown is quite decent, and by paying out more than half of its earnings as dividends, the company is striking a reasonable balance between reinvestment and returns to shareholders.

Conclusion

To summarise, shareholders should always check that American Water Works Company's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. American Water Works Company gets a pass on its dividend payout ratio, but it paid out virtually all of its cash flow as dividends. This may just be a one-off, but we'd keep an eye on this. We like that it has been delivering solid improvement in its earnings per share, and relatively consistent dividend payments. In sum, we find it hard to get excited about American Water Works Company from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 13 analysts we track are forecasting for American Water Works Company for free with public analyst estimates for the company.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.