Here's what fees, rates may look like next year

How much it will cost for the city to run – and where those taxpayer dollars are allocated – will be hammered out in the upcoming weeks as city officials wrangle over the costs of community wants and needs.

Ringing in at about $1.5 billion, the proposed budget slightly outpaces last year’s adopted budget of $1.4 billion.

Ultimately what is approved by the City Council will affect all residents by way of property tax payments, utilities costs and quality of life investments, such as park rehabilitation.

Historically, the proposed operating and capital improvement budgets see a number of changes before they are approved by the City Council, following lengthy – and sometimes, contentious – conversations.

The formal process to eventually adopt a budget started this week, with the first round of workshops.

The final product must be passed by vote before the start of the new fiscal year on Oct. 1.

Here’s a breakdown of what the council will be considering.

Property taxes

Final decisions on the ad valorem tax rate won't be made for about a month, but the outcome will play an integral role in the shape of the budget.

Property taxes are among the most substantial revenue pieces in the overall budget.

Although the numbers needed to fully consider a tax rate have not been finalized, preliminary estimates show about $167.5 million in property tax revenue could be collected by the city, using a rate of 62 cents per $100 valuation, according to city documents.

It is the same tax rate as used this year, when it is estimated the city will net about $157.3 million, officials said.

The estimated rise in revenue – despite no changes to the tax rate – is driven by new properties added to the tax rolls, as well as increases in appraisals for existing properties.

The city would have the option to adopt what is called a no-new-revenue rate – that is, a lower tax rate that would bring in the same amount of funding next year as the current year.

A public hearing on the property tax rate is scheduled for the Aug. 29 City Council meeting.

Votes on the tax rate are anticipated in the Aug. 29 and Sept. 5 City Council meetings.

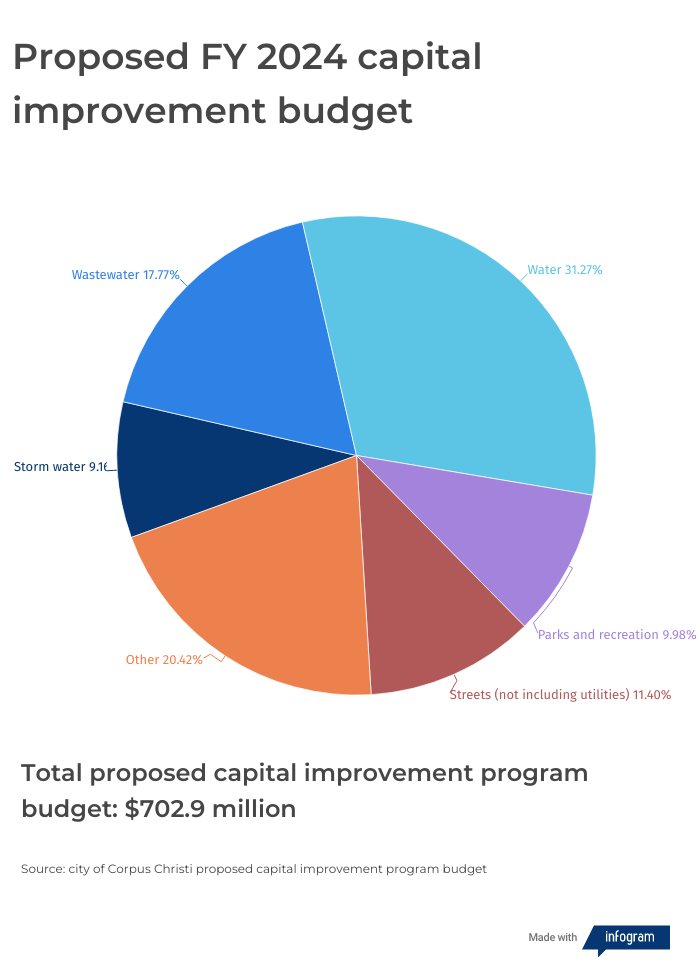

Infrastructure

Some of the key points in the budget will be those that appear directly on residents’ utility bills – including proposed increases in water, wastewater, storm water and trash pickup services.

Proposal records show an average homeowner − using about 6,000 gallons of water per month and with wastewater costs based on a 5,000 gallon winter average − would see their bill rise an estimated $6.50 per month, when also taking into account storm water and solid waste fees.

Costs for natural gas – and the street fees assessed on utility bills – would have no change under the proposal, according to city documents.

Water

Proposed changes to the water rate structure – essentially the formula that determines how much customers pay— would likely be one of the most notable proposed changes in how the city accounts for costs, if adopted.

The idea is to make the rate structures more equitable between customers inside the city limits and outside city limits, as well as classifications of customers – such as those considered large volume users compared to residential customers –City Manager Peter Zanoni has said.

For residential customers living inside city limits, it’s estimated bills would increase by about $1.80, city records show.

For large volume customers outside city limits – and using a 10-inch meter and 90 gallons per month – the increase is estimated to be about $179,000, according to a recent presentation.

Wastewater

Similar to the proposed water cost changes, potential changes to the wastewater rate structure are aimed at creating equity between users inside city limits and users outside city limits, Zanoni has said.

City records show costs would increase nearly across the board for customers – commercial, inside and outside city limits, and residential inside city limits – with the exception of residential service outside the city limits, which would see a slight drop.

For residents inside city limits with a 5,000-gallon winter quarter average, that would come out to increase of about $2.40.

Solid waste, storm water

Proposed storm water fee increases are intended to cover additional services, such as boosting street sweeping by about 25%, city records show.

The fees for the majority of residential customers – those whose properties are between 3,000 to 4,000 square feet of impervious area (anywhere that something like rain water wouldn't be absorbed) – would increase by about $1.15, according to a recent presentation.

It had been considered last year that solid waste service charges for residents tick up by about $1.15 – a proposal largely based on rising gas and personnel costs – but was scrapped by the council. Presentations show the proposed increase has returned for discussion, driven by cost-of-service models.

Community meetings

Monday

6 – 7 p.m.

Owen R. Hopkins Public Library

3202 Mckinzie Rd.

Wednesday

6 – 7 p.m.

Del Mar College – Center for Economic Development, Room 106

3209 S. Staples St.

Thursday

6 – 7 p.m.

Water Utilities Building, Choke Canyon Room

Monday, Aug. 14

6 – 7 p.m.

Ethyl Eyerly Senior Center

654 Graham Rd.

Wednesday, Aug. 16

6 – 7 p.m.

Del Mar College-Oso Creek Campus

Culinary Building, Community Room CA 209-210

Council workshops

Thursday, Aug. 10

9 a.m.

Council chambers, City Hall

1201 Leopard St.

Public works, storm water, solid waste, property tax rate and exemptions

Monday, Aug. 21

9 a.m.

Council chambers, City Hall

1201 Leopard St.

Water, wastewater, gas and capital improvement program

Thursday, Aug. 24

9 a.m.

Council chambers, City Hall

1201 Leopard St.

Economic development, hotel occupancy tax funds, American Bank Center. Visit Corpus Christi, airport and potential adjustments

More: How much will you pay in Corpus Christi property tax, utility rates? Here's what it may cost.

This article originally appeared on Corpus Christi Caller Times: Increases proposed for city utilities, including water and wastewater