Here's What FRP Holdings, Inc.'s (NASDAQ:FRPH) Shareholder Ownership Structure Looks Like

If you want to know who really controls FRP Holdings, Inc. (NASDAQ:FRPH), then you'll have to look at the makeup of its share registry. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

FRP Holdings is not a large company by global standards. It has a market capitalization of US$425m, which means it wouldn't have the attention of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions own shares in the company. Let's delve deeper into each type of owner, to discover more about FRP Holdings.

Check out our latest analysis for FRP Holdings

What Does The Institutional Ownership Tell Us About FRP Holdings?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

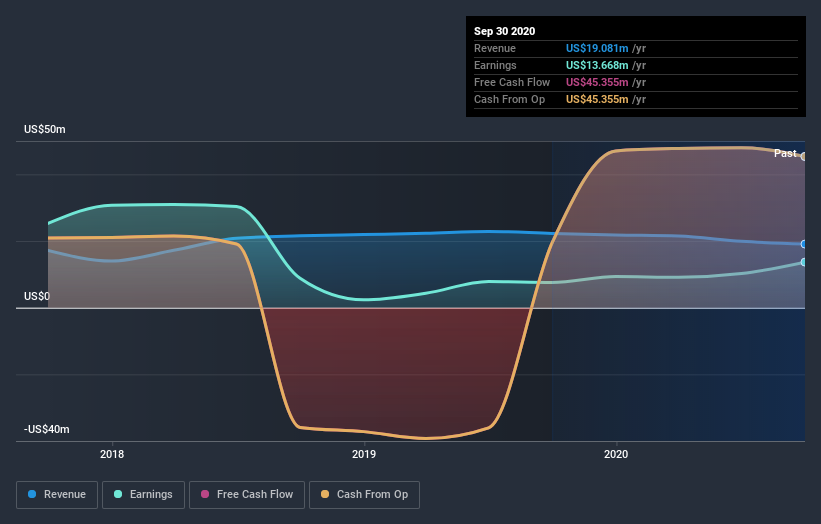

We can see that FRP Holdings does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of FRP Holdings, (below). Of course, keep in mind that there are other factors to consider, too.

Hedge funds don't have many shares in FRP Holdings. With a 15% stake, CEO John Baker is the largest shareholder. With 10% and 9.7% of the shares outstanding respectively, Charles D. Hyman & Company and Cynthia Ogden are the second and third largest shareholders.

We also observed that the top 6 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of FRP Holdings

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders maintain a significant holding in FRP Holdings, Inc.. Insiders own US$161m worth of shares in the US$425m company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

With a 12% ownership, the general public have some degree of sway over FRP Holdings. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for FRP Holdings (1 is a bit concerning!) that you should be aware of before investing here.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.