Here's how to take full advantage of Ohio's sales tax holiday this weekend.

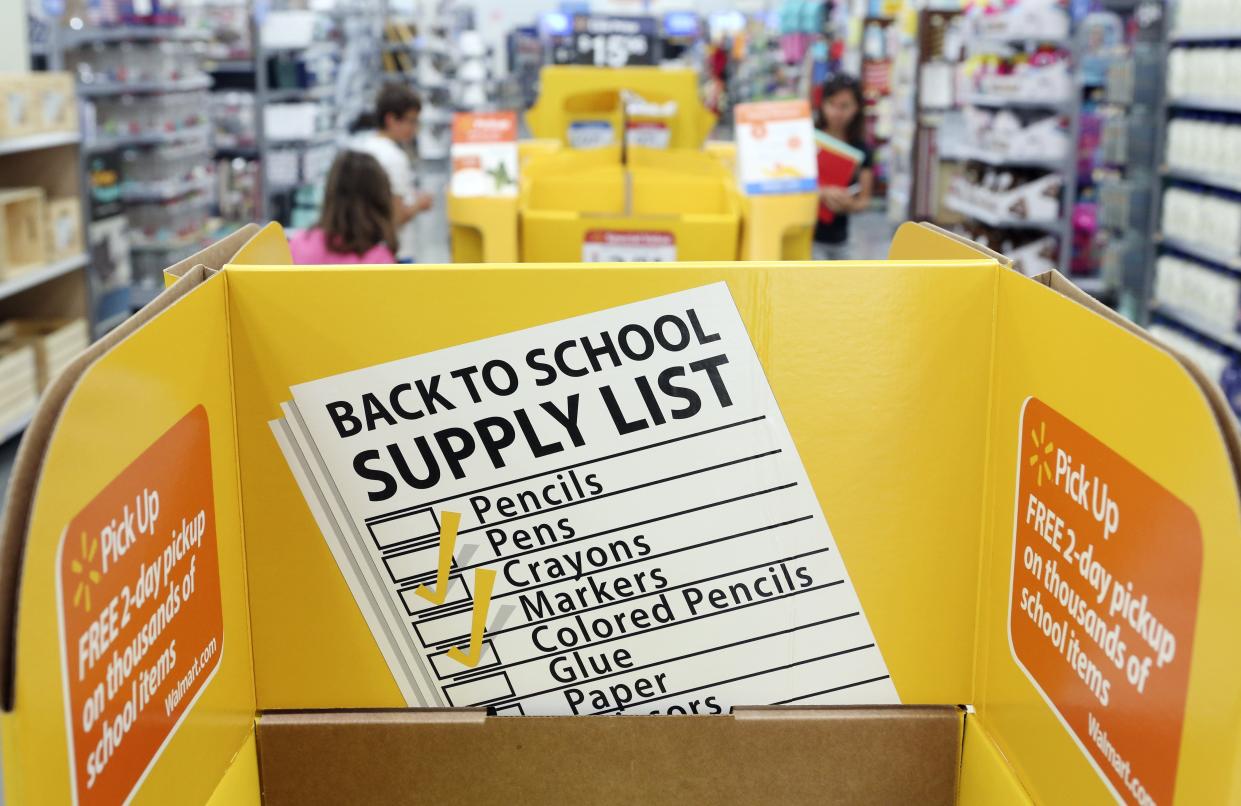

Back to school season is approaching and so is Ohio's sales tax holiday weekend. With much shopping ahead of you, it's best to know how to take full advantage.

Ohio's sales tax holiday is the first Friday, Saturday and Sunday in August of each year, making this year's tax-free weekend Aug. 4-6.

According to the National Retail Federation, back-to-school spending is expected to reach "record levels" for the country this year, as the total amount consumers are expected to spend rises to $41.5 billion, in comparison to last year's $36.9 billion.

Families with children in K-12 are expected to spend an average of $890.07 on back-to-school supplies for the 2023-2024 school year, up $25 from last year, according to the federation.

Additionally, families preparing their children to go back to college are expected on average to spend $1,366.95 per household, $167.52 more than last year, with the total expected amount of back-to-college spending to be around $94 billion for the entire country, $20 billion more than last year.

What qualifies as tax exempt?

The sales tax exemption is limited to school supplies/school learning materials and clothing items which are defined at Ohio.gov. You can buy as many items as you'd like regardless of the overall cost, as long as each individual item does not exceed $75, and each individual school supply/instructional material does not exceed $20. This means a $50 pair of jeans would qualify as tax exempt, but a $50 calculator would not.

Using coupons or discounts does not affect the sales tax exemption as long as the items still cost less than $75 or $20. Items purchased online still qualify for the exemption and the same rules apply.

How you can prepare for Ohio's sales tax holiday

Back-to-school shoppers can best take advantage of the tax-free weekend by reading the Ohio Department of Taxation's frequently asked questions page, which lists what qualifies as tax exempt, according to a 2022 article by Ohio Attorney General Dave Yost.

It is important to review the return policies of whichever establishment you plan on buying from, while taking extra precautions to ensure that you are buying from a reputable and safe store when purchasing online, according to the article.

Back to school shopping trends

According to a survey conducted by NRF on 7,843 consumers over the age of 18, most people are back-to-school shopping online (49%) followed by department store shopping (35%) and/or shopping at discount stores (33%).

“Consumers are stretching their dollars by comparing prices, considering off-brand or store-brand items, and are more likely to shop at discount stores than last year,” prosper executive vice president of strategy Phil Rist said in an NRF article.

For both back-to-school and back-to-college shoppers, electronics are the leading category regarding the amount of money households are spending on school-related items, according to NRF. Overall top categories for households with k-12 children were electronics, clothes and shoes, while the top categories for households with college kids were electronics, furnishing for dorms and apartments and clothes.

According to NRF, Inflation/higher prices are the top societal concern for the general public. 67% of shoppers have reported higher prices for clothing and accessories (77%), school supplies (67%), shoes (59%), electronics (58%) and furniture (23%).

aesmith@gannett.com

@arismith02

This article originally appeared on The Columbus Dispatch: How to prepare for Ohio's annual sales tax holiday weekend.