Here's how much you would save — and who benefits the most — under Kansas GOP tax cut plan

Kansas Republicans have sent a tax cut package worth $1.6 billion over three years to Democratic Gov. Laura Kelly.

Kelly is expected to veto the tax cut plan because of a flat tax piece that she and other Democrats are opposed to, which could result in all of the tax cut pieces failing. But Republicans will likely attempt to override the veto — a difficult prospect, requiring at least one senator to flip-flop.

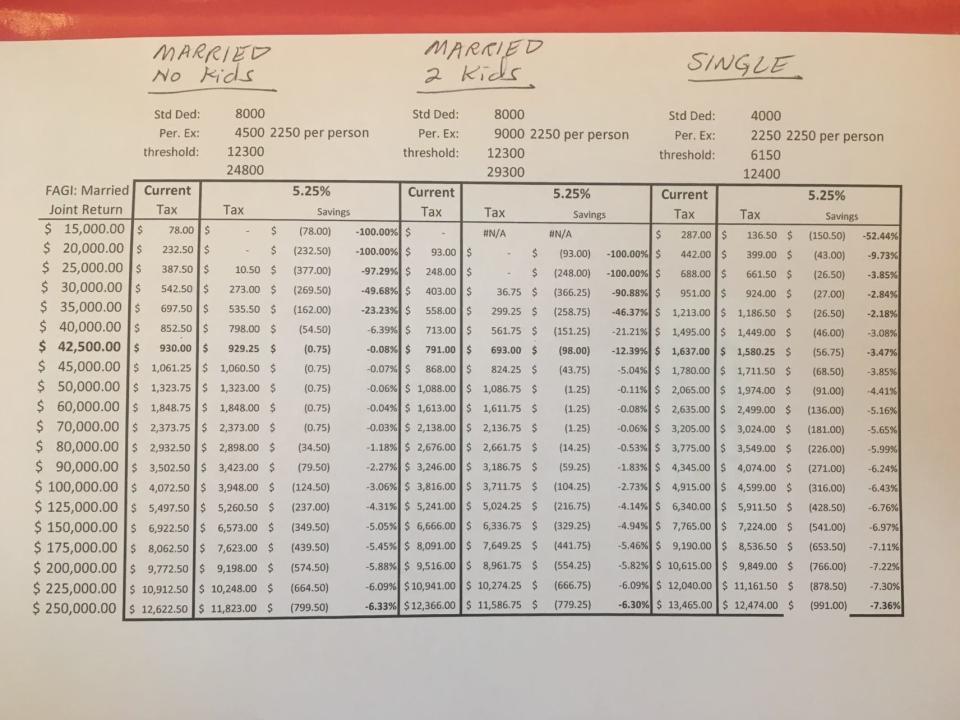

Here's how much you would save under the pieces of the Republican tax cut plan if the governor signs the bill or legislators override a veto.

Income tax cuts headlined by a single rate

The biggest piece of the tax package is imposing a single rate income tax, also known as a flat tax, of 5.25%. The first $6,150 in income for individuals and $12,300 for couples would be exempt.

The Kansas Department of Revenue last year analyzed the impact of a 5.25% flat tax with $6,150 and $12,300 exemptions. The numbers show the poorest Kansans save the most in terms of their current tax bill, the richest save the most in terms of total dollar amount and proportion of the total tax relief, and middle income people save the least.

For an individual:

If you make $15,000, you would save $150.50 off the current tax of $287.

If you make $35,000, you would save $26.50 off the current tax of $1,213.

If you make $50,000, you would save $91 off the current tax of $2,065.

If you make $80,000, you would save $226 off the current tax of $3,775.

If you make $125,000, you would save $428.50 off the current tax of $6,340.

For a married couple with no kids:

If you make $15,000, you would save $78, the entirety of the current tax of $78.

If you make $35,000, you would save $162 off the current tax of $697.50.

If you make $50,000, you would save $0.75 off the current tax of $1,323.75.

If you make $80,000, you would save $34.50 off the current tax of $2,932.50.

If you make $125,000, you would save $237 off the current tax of $5,497.50.

For a married couple with two kids:

If you make $15,000, you would save $0 because the current tax is $0.

If you make $35,000, you would save $258.75 off the current tax of $558.

If you make $50,000, you would save $1.25 off the current tax of $1,088.

If you make $80,000, you would save $14.25 off the current tax of $2,676.

If you make $125,000, you would save $216.75 off the current tax of $5,241.

A list of more income levels is available below:

The flat tax portion of the bill would amount to $91.5 million in tax cuts in fiscal year 2025, $306 million in 2026 and $309.1 million in 2027.

The plan also includes other income tax cuts.

One is indexing the standard deduction to inflation. The current standard deduction is $3,500 for an individual and $8,000 for married filing jointly.

The tax plan also includes a $50 increase in 2024 to the personal exemption, from $2,250 to $2,300, plus a cost-of-living adjustment starting in 2025.

The new 5.25% flat tax would kick in on income, for an individual, that is above the $6,150 initial exemption plus the unchanged $3,500 standard deduction and the new $2,300 personal exemption. So individuals making less than $11,950 would see no income tax.

For people above that amount, the inflation indexes would create some tax savings.

If the standard deduction inflation adjustment were to be 4% in the 2024 — which is what the Kansas Department of Revenue has previously assumed in estimates — the first year the provision would be in effect would cause the deductions to increase by $140 to $3,640 for individuals and by $320 to $8,320 for couples.

The 5.25% tax rate compared to the $140 and $320 increases in the standard deductions means individuals would save of $7.35 in the first year while couples get $16.80. The savings would grow in future years as the inflation adjustment further increases the standard deduction.

The $50 increase in the personal exemption would save $2.63 in taxes in the first year. The following year, if the inflation adjustment were 4%, the savings would be $4.83. The savings would then continue to grow.

The standard deduction cost-of-living adjustment would cost the state $15.3 million in tax cuts in fiscal year 2025, $19.5 million in 2026 and $25 million in 2027.

The personal exemption piece costs the state $2.1 million in fiscal year 2025, $9.3 million in 2026 and $16.7 million in 2027.

The plan also eliminates state income taxes on Social Security benefits. Under current law, people with incomes of less than $75,000 already have an exemption on their Social Security benefits, then there is a cliff once your income hits $75,000.

If you get Social Security but your income is less than $75,000, you get no tax relief because your Social Security is not currently taxed.

If your income is above $75,000, your Social Security is currently taxed but no longer would be. The savings are likely equivalent to your current Social Security benefit times the 5.7% of the current top tax bracket.

If you don't get Social Security benefits, you won't get any tax relief from that provision.

The Social Security tax cut equates to $152.1 million in fiscal year 2025, $120.7 million in 2026 and $124.4 million in 2027.

The tax plan also includes a cut to the privilege tax, which is a form of tax on income at banks and other financial institutions. Individual Kansans would not see any direct tax relief. Bankers would see the company's normal tax rate drop from 2.25% to 1.63% while trust companies and saving and loan associations have their rate drop from 2.25% to 1.61%.

The cost to the state is $6.8 million in fiscal year 2025, $7.4 million in 2026 and $7.5 million in 2027.

Homeowners would get a property tax cut

Property tax bills are largely used to fund local government, but the state does have a piece of the pie that would be cut in HB 2284.

Kansas collects 20 mills of property tax that are used to help fund local schools, but a portion of a home's value is exempt. The exemption was set at $40,000 two years ago then indexed to inflation, which has since pushed it to $42,049.

That exemption would increase to $100,000 in HB 2284.

If your house or other residential property is worth $100,000 or more, the increased exemption saves you $133.29 a year.

For homes worth less than $42,049, the homeowner gets zero tax relief.

If your residential property is worth between $42,049 and $100,000, here is how you determine your tax relief. Take the appraised value, subtract the current exemption of $42,049, multiply that by 0.115 for the constitutional 11.5% assessment rate, divide it by 1,000 because a mill equals $1 in tax per $1,000 in assessed valuation, then multiply by 20 because the state levy is 20 mills.

The tax cut totals $84.8 million in fiscal year 2025, $89.5 million in 2026 and $94.3 million in 2027. The lost revenue would not result in a cut to school funding because the state general fund by law would cover the difference.

Grocery food would get accelerated sales tax cut

The plan would accelerate the elimination of the state sales tax on grocery food to April 1.

That would take the remaining state portion of the sales tax from 2% to 0%. For every $100 in groceries, that would be $2 in savings.

Based on past estimates from the governor's office that fully eliminating the old 6.5% food sales tax would save a family of four about $500 a year, eliminating the last 2% tax from the last nine months of the year would equate to roughly $115 in tax relief in 2024.

Because the state sales tax on food is already scheduled to be fully eliminated on Jan. 1, 2025, there would be no additional sales tax relief from HB 2284 past that date.

For the state, it would mean $4.2 million less tax revenue in fiscal year 2024 and $15 million less in fiscal year 2025, but no fiscal affect after that.

This article originally appeared on Topeka Capital-Journal: Here's how much Kansas taxpayers would save under GOP flat tax plan