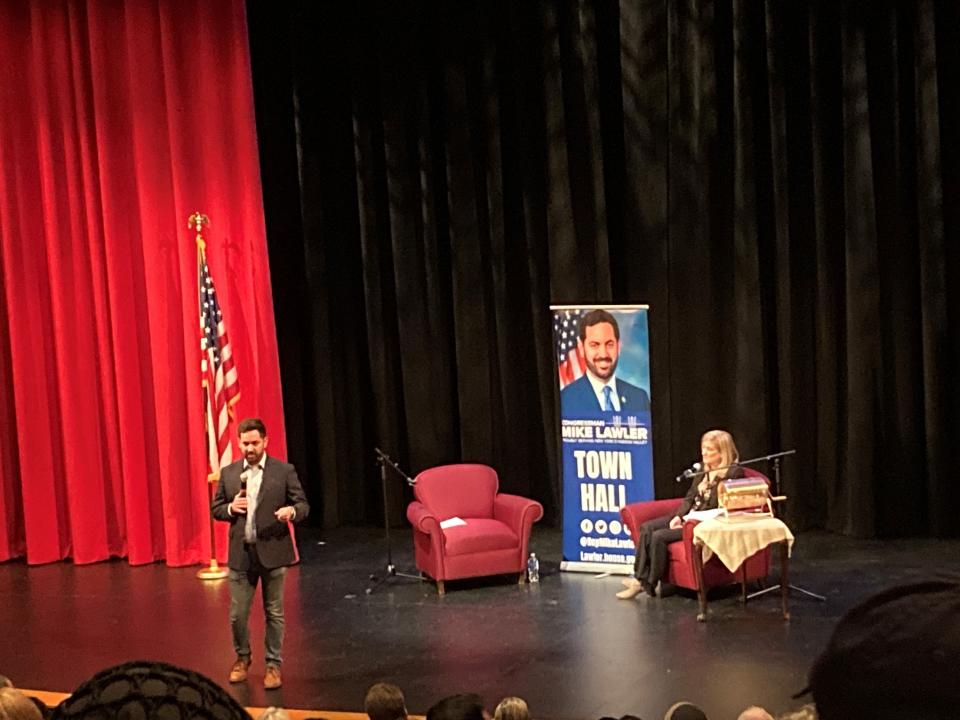

Here's what Rep. Mike Lawler said at sold-out Rockland Town Hall

Rep. Mike Lawler’s sold-out Town Hall at Rockland Community College on Sunday was one of the hottest tickets in Rockland last weekend. But a friend whose plans changed offered me his seat to hear my Congressman answer questions in an unscripted event.

I took him up on the offer. I was interested in hearing Lawler’s pitch to constituents in Rockland, on his home turf in the 17th Congressional District — a battleground in the fight for control of the House of Representatives in 2024.

Outside the Town Hall, activists chanted for a cease-fire in the bloody conflict between Israel and Hamas in Gaza, while hundreds more rallied in support of Israel. Inside the auditorium, Lawler told a supportive crowd of about 300, many of whom were from the Rockland Jewish community, that he’s waiting for Hamas to waive the white flag.

“The best way for a cease-fire now is for Hamas to surrender, period,” said Lawler, R-Pearl River.

Lawler, one of 18 Republicans who won districts that voted for Democrat Joe Biden for president in 2020, answered questions on federal tax policy, the chaotic Republican struggles over House leadership, and the future of Social Security and Medicare.

He faces a possible GOP primary from Bill Maloney, a young Rockland Republican, while three Democrats — former Rep. Mondaire Jones, Katonah activist Liz Geregthy, and former Bedford Supervisor Mary Ann Carr — vie for the Democratic nomination.

Still likes McCarthy

Lawler, who voted for McCarthy in mid-October during the failed attempt by Donald Trump ally Rep. Jim Jordan to win the speakership, said he still thinks McCarthy is the right person for the job. He said he voted to back Rep. Mike Johnson, the right-leaning Louisiana Republican, to end the intraparty squabble.

“It’s not a question of agreeing or not agreeing with him," said Lawler. "It’s a function of we need to unify behind someone so we can get back to work on behalf of the American people, so we can focus on the task at hand: the appropriations bill, securing our border, and getting aid to Israel and Ukraine.”

More: Mike Lawler wants to keep Social Security solvent, but won't say how he'll pay for it

For Lawler and the House Republicans, that means getting out his budget knife to cut federal spending.

But exactly where he wants to cut remains to be seen. Earlier this fall, he voted for a continuing resolution to keep the government running that would have cut discretionary spending by 30%, slashed aid to Israel by close to $1 billion, and cut funding for federal law enforcement. That bill, however, failed to pass.

When a constituent asked about that vote, Lawler said it was a “negotiating position” in the GOP conference.

“Ultimately, what we put through the House was not going to be the final bill,” said Lawler. “It was meant to be a negotiating position. Ultimately, we’re not cutting support for law enforcement, we aren’t cutting for our vets."

Those negotiating positions, meanwhile, remain talking points for many in the narrow Republican House majority, which will make yet another attempt at passing appropriation bills in January and February.

More: Will Mike Lawler face GOP primary? Trump loyalist weighs 2024 race against House freshman

Reining in spending

Lawler said the need to “rein in spending” was his top priority, citing the nation’s $34 trillion debt. Increases in spending for Social Security and Medicare are among the culprits, he said. He acknowledged it wasn’t a popular topic to address.

“Much of the spending is mandatory, and nobody wants to touch mandatory because that’s the third rail,” he said. “But if we do nothing to either one right now, both programs are going broke in the next decade. We are going to have to deal with it realistically. We do not want to cut benefits to anyone, but we have to deal with how we’re going to pay for it long-term.”

Lawler’s commitment to reining in spending to curb the deficit does not extend to the revenue side of the federal budget, where Lawler on Sunday proposed cutting taxes. He wants to raise the $10,000 cap on the deductibility of state and local taxes, an issue he views as “the biggest issue that matters to our constituents.”

He also proposed tax breaks for parents of children who send their children to private school, allowing them to deduct tuition costs.

Lawler has declined to say how much his tax-cutting plans will cost the U.S. Treasury.

He acknowledged that the cap on so-called SALT deductions was enacted in 2017 by his Republican brethren in the House and then-President Donald Trump to pay for the Tax Cuts and Jobs Act, which lowered tax rates overall, and provided major savings to high-end taxpayers.

That law expires in 2025, so Congress has begun discussing how those tax cuts may be extended, and for the GOP deficit hawks, how to pay for them.

Lawler's Speaker votes Mike Lawler has voted against Jim Jordan for Speaker multiple times: Where they differ

SALT deductions

At a minimum, Lawler is seeking support for a bill to double the cap to $20,000 for married couples filing jointly, who are currently limited to deducting just $10,000, the same amount allowed for single filers.

A second bill would raise the cap on SALT deductions to $100,000, an amount so high that Lawler estimates it would include almost every resident of the 17th District.

Lawler said he’s working to educate his Republican colleagues on why it’s important to pass a bill that has support in high property-tax states on the East and West coasts.

Tax deductions for private school tuition

Lawler also wants to provide federal tax cuts to parents who send their children to private schools through an “education investment tax credit” program. Currently the federal government provides tax credits of $2,500 to parents who pay more than $4,000 in costs for higher education expenses for their children.

“I do believe that if people are choosing on top of the tax dollars they pay for our local school property taxes, that if they chose to send their child to private schools, they should be to deduct that off their taxes,” said Lawler.

For Lawler, it’s about making it more affordable for parents who don’t want to send their children to local public schools.

“I fundamentally believe that no child should be left in a failing school system or district,” he said.

More: Monitors warn of $44M deficit if voters keep tanking East Ramapo school budgets

He noted there were “challenges” in the East Ramapo district, where about 30,000 of the district’s close to 40,000 students attend private schools, many of which serve the district’s Orthodox Jewish community.

“You have a district where 75% of students enrolled in the district attend private schools,” he said. “How do you deal with that to ensure that the students attending private schools are getting the mandated services they are entitled to, while ensuring that the school district is able to provide critical services to the students in the public school system?”

He said it’s time to create a new paradigm.

“It’s because it is not structured correctly,” Lawler said. “Given the fact that you have 75% of students enrolled in a private school, I don’t begrudge anybody sending their child to a private school. But I want to make sure that on both sides, every single child is getting the quality education they deserve.”

Would providing tax breaks to the families of children who attend private schools attend achieve that end? We’ll be waiting for Lawler to submit legislation to accomplish his goal.

Sign up for Wilson's weekly newsletter for insights into his Tax Watch columns.

David McKay Wilson writes about tax issues and government accountability. Follow him on Twitter @davidmckay415 or email him at dwilson3@lohud.com.

This article originally appeared on Rockland/Westchester Journal News: Rockland NY Town Hall: What Rep. Mike Lawler said at sold-out event