Here's What We Think About Altabancorp's (NASDAQ:ALTA) CEO Pay

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

Len Williams has been the CEO of Altabancorp (NASDAQ:ALTA) since 2018, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Altabancorp.

See our latest analysis for Altabancorp

Comparing Altabancorp's CEO Compensation With the industry

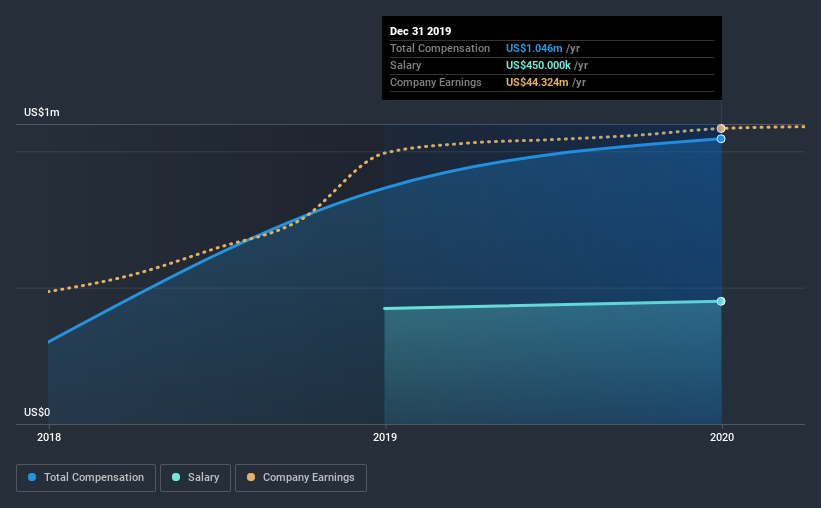

At the time of writing, our data shows that Altabancorp has a market capitalization of US$390m, and reported total annual CEO compensation of US$1.0m for the year to December 2019. We note that's an increase of 21% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$450k.

On examining similar-sized companies in the industry with market capitalizations between US$200m and US$800m, we discovered that the median CEO total compensation of that group was US$1.3m. This suggests that Altabancorp remunerates its CEO largely in line with the industry average. What's more, Len Williams holds US$349k worth of shares in the company in their own name.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$450k | US$424k | 43% |

Other | US$596k | US$441k | 57% |

Total Compensation | US$1.0m | US$865k | 100% |

On an industry level, roughly 43% of total compensation represents salary and 57% is other remuneration. Altabancorp is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Altabancorp's Growth

Altabancorp has seen its earnings per share (EPS) increase by 19% a year over the past three years. In the last year, its revenue is up 3.4%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Altabancorp Been A Good Investment?

Since shareholders would have lost about 19% over three years, some Altabancorp investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we touched on above, Altabancorp is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. On the other hand, the company has logged negative shareholder returns over the previous three years. But earnings growth is moving in a favorable direction, certainly a positive sign. Considering positive earnings growth, we'd say compensation is fair, but shareholders may be wary of a bump in pay before the company logs positive returns.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for Altabancorp (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Altabancorp, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.