Here's What We Think About Sino-Ocean Group Holding Limited's (HKG:3377) CEO Pay

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Ming Li has been the CEO of Sino-Ocean Group Holding Limited (HKG:3377) since 2006. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for Sino-Ocean Group Holding

How Does Ming Li's Compensation Compare With Similar Sized Companies?

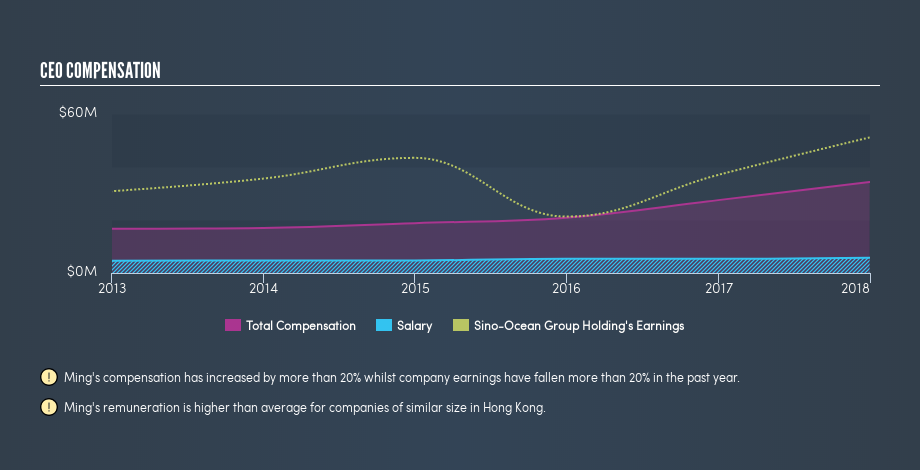

According to our data, Sino-Ocean Group Holding Limited has a market capitalization of HK$25b, and pays its CEO total annual compensation worth CN¥34m. (This figure is for the year to December 2017). While we always look at total compensation first, we note that the salary component is less, at CN¥5.8m. When we examined a selection of companies with market caps ranging from CN¥14b to CN¥44b, we found the median CEO total compensation was CN¥3.1m.

Thus we can conclude that Ming Li receives more in total compensation than the median of a group of companies in the same market, and of similar size to Sino-Ocean Group Holding Limited. However, this doesn't necessarily mean the pay is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business.

You can see, below, how CEO compensation at Sino-Ocean Group Holding has changed over time.

Is Sino-Ocean Group Holding Limited Growing?

Over the last three years Sino-Ocean Group Holding Limited has grown its earnings per share (EPS) by an average of 26% per year (using a line of best fit). In the last year, its revenue is down -9.6%.

This demonstrates that the company has been improving recently. A good result. Revenue growth is a real positive for growth, but ultimately profits are more important. It could be important to check this free visual depiction of what analysts expect for the future.

Has Sino-Ocean Group Holding Limited Been A Good Investment?

Sino-Ocean Group Holding Limited has served shareholders reasonably well, with a total return of 25% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

We compared the total CEO remuneration paid by Sino-Ocean Group Holding Limited, and compared it to remuneration at a group of similar sized companies. Our data suggests that it pays above the median CEO pay within that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. We also note that, over the same time frame, shareholder returns haven't been bad. You might wish to research management further, but on this analysis, considering the EPS growth, we wouldn't call the CEO pay problematic. Shareholders may want to check for free if Sino-Ocean Group Holding insiders are buying or selling shares.

If you want to buy a stock that is better than Sino-Ocean Group Holding, this free list of high return, low debt companies is a great place to look.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.