Here's Why BQE Water (CVE:BQE) Has A Meaningful Debt Burden

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that BQE Water Inc. (CVE:BQE) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for BQE Water

How Much Debt Does BQE Water Carry?

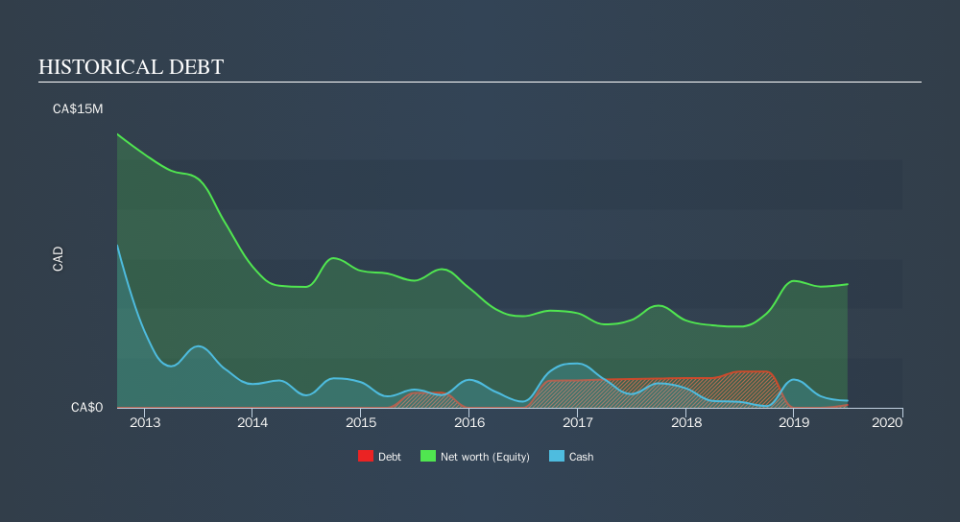

You can click the graphic below for the historical numbers, but it shows that BQE Water had CA$146.7k of debt in June 2019, down from CA$1.83m, one year before. But it also has CA$359.9k in cash to offset that, meaning it has CA$213.2k net cash.

How Strong Is BQE Water's Balance Sheet?

We can see from the most recent balance sheet that BQE Water had liabilities of CA$1.73m falling due within a year, and liabilities of CA$358.5k due beyond that. On the other hand, it had cash of CA$359.9k and CA$1.90m worth of receivables due within a year. So it can boast CA$170.3k more liquid assets than total liabilities.

This state of affairs indicates that BQE Water's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the CA$8.59m company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that BQE Water has more cash than debt is arguably a good indication that it can manage its debt safely.

Notably, BQE Water made a loss at the EBIT level, last year, but improved that to positive EBIT of CA$109k in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since BQE Water will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. BQE Water may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last year, BQE Water burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

While it is always sensible to investigate a company's debt, in this case BQE Water has CA$213k in net cash and a decent-looking balance sheet. So although we see some areas for improvement, we're not too worried about BQE Water's balance sheet. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.