Here's Why Chen Xing Development Holdings (HKG:2286) Has A Meaningful Debt Burden

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Chen Xing Development Holdings Limited (HKG:2286) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Chen Xing Development Holdings

What Is Chen Xing Development Holdings's Debt?

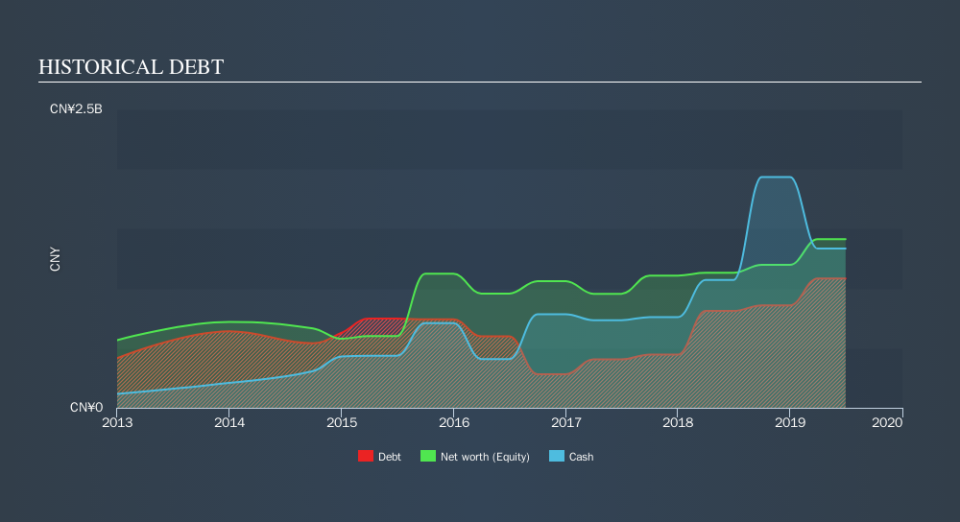

As you can see below, at the end of June 2019, Chen Xing Development Holdings had CN¥1.08b of debt, up from CN¥811.5m a year ago. Click the image for more detail. However, it does have CN¥1.33b in cash offsetting this, leading to net cash of CN¥249.5m.

How Healthy Is Chen Xing Development Holdings's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Chen Xing Development Holdings had liabilities of CN¥7.81b due within 12 months and liabilities of CN¥873.1m due beyond that. Offsetting these obligations, it had cash of CN¥1.33b as well as receivables valued at CN¥240.0m due within 12 months. So it has liabilities totalling CN¥7.11b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the CN¥1.18b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt At the end of the day, Chen Xing Development Holdings would probably need a major re-capitalization if its creditors were to demand repayment. Given that Chen Xing Development Holdings has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

It is just as well that Chen Xing Development Holdings's load is not too heavy, because its EBIT was down 30% over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Chen Xing Development Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Chen Xing Development Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Chen Xing Development Holdings actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

While Chen Xing Development Holdings does have more liabilities than liquid assets, it also has net cash of CN¥249.5m. The cherry on top was that in converted 171% of that EBIT to free cash flow, bringing in CN¥729m. Despite the cash, we do find Chen Xing Development Holdings's level of total liabilities concerning, so we're not particularly comfortable with the stock. Over time, share prices tend to follow earnings per share, so if you're interested in Chen Xing Development Holdings, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.