Here's why your Colorado tax refund might be bigger (and later) than you expected for 2022

UPDATE, 6:20 P.M. Friday, Feb. 10: The TABOR tax refund checks given in 2022 under the name Colorado Cash Back won't be subject to federal taxation, Colorado Gov. Jared Polis announced Friday. The remainder of this story has been updated to reflect that.

ORIGINAL STORY: As the Colorado Department of Revenue gets ready to begin accepting tax returns yet for the 2022 tax year, you might be wondering why it includes a "sales tax refund" that might be causing you to get a bigger refund.

And the early birds also might be wondering why they've already gotten a federal refund but have seen no sign of a state refund yet.

We've got answers.

Why am I getting a Colorado sales-tax refund?

It's all because of the Taxpayers' Bill of Rights, also called TABOR, which went into effect in 1992 with voter approval. Basically, it says tax revenue in the state of Colorado can grow only so much in balance with inflation and population, and then anything above that has to be refunded to the taxpayers.

In 2022, Colorado's tax revenue growth exceeded the cap, necessitating refunds.

But wait! Didn't we already get that money last year, when the Colorado Legislature passed a measure to offer up those TABOR refunds in the form of a direct payment to taxpayers?

Yes, the TABOR refunds became the Colorado Cash Back checks of 2022, when individuals received $750 and couples received $1,500.

But in the time since those payments were given, the tax money kept coming in and projections continued to be adjusted, and now more money has to be refunded to taxpayers. Only now these refunds are taking the form of a tax refund given through 2022 tax returns.

The sales tax refund happened in the 2021 tax year, too, but those refunds were smaller than this year's will be.

More on money:Fort Collins to contract with Republic Services for residential trash hauling in city limits

How much will I get from the sales tax refund?

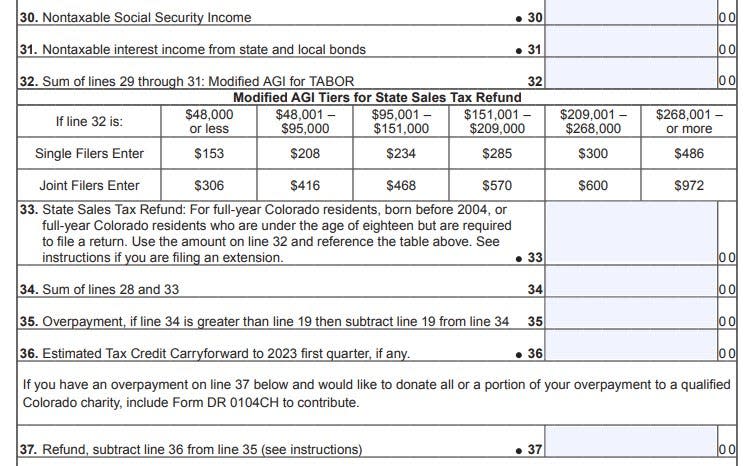

The amount you'll get depends on your income. Below is the refund, based on a modified adjusted gross income amount that tax programs/forms will help you determine.

The first number is for single filers, and the second for joint filers:

$48,000 or less: $153 / $306

$48,001 to $95,000: $208 / $416

$95,001 to $151,000: $234 / $468

$151,001 to $209,000: $285 / $570

$209,001 to $268,000: $300 / $600

$268,001 or more: $486 / $972

There was also a voter-approved tax cut

There's another reason your tax bill might be lower this year: In November, voters passed an income tax cut.

The Colorado income tax rate is now 4.4%, down from 4.55%. (Although it's relevant to note that without that permanent tax cut, the TABOR mechanism could have temporarily lowered the rate to 4.5% anyway.)

Also worth noting: From 2000 to 2018, the tax rate was 4.63% until another voter-approved tax cut in 2020 lowered it.

Who is eligible for the sales tax refund?

Full-year Colorado residents who were 18 or older as of Jan. 1, 2022, can get this refund by filing by April 18. If you file an extension, there are more limitations on whether you can claim it.

Part-year and nonresidents are not eligible, nor is anyone incarcerated in the Department of Corrections, a county or municipal jail.

When will I be able to file my Colorado taxes?

The Colorado Department of Revenue is a bit late accepting tax returns this year. Normally returns can be filed in January, but a note on the agency's website says the state will begin accepting e-filed returns for most people no later than Friday, Feb. 10, and people who use the state's Revenue Online website to file their taxes will be able to do so no later than Wednesday, Feb. 22.

A news release from the department said the delay is to accommodate changes such as the voter-approved income tax cut and "multiple legislative changes."

That means if you're eagerly awaiting that extra refund, you'll have to be patient as you wait for the state to accept it.

How can I track the status of my Colorado tax refund?

Visit the Colorado Department of Revenue's "Revenue Online" page, where you can look up the status of your tax refund.

The TABOR refund Colorado Cash Back is not taxable

The Colorado Department of Revenue says on its website the payment is not taxable. But the IRS on Feb. 3 issued guidance to delay filing your taxes until the agency could offer more clarity on whether "special tax refunds or payments made by states in 2022" were taxable by the IRS.

However, on Friday, the IRS issued a statement saying that people do not need to report the Colorado Cash Back payments on their federal tax return.

This article originally appeared on Fort Collins Coloradoan: Why is my Colorado tax refund larger? And why haven't I gotten it yet?