Here's Why Hills (ASX:HIL) Can Afford Some Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Hills Limited (ASX:HIL) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Hills

What Is Hills's Debt?

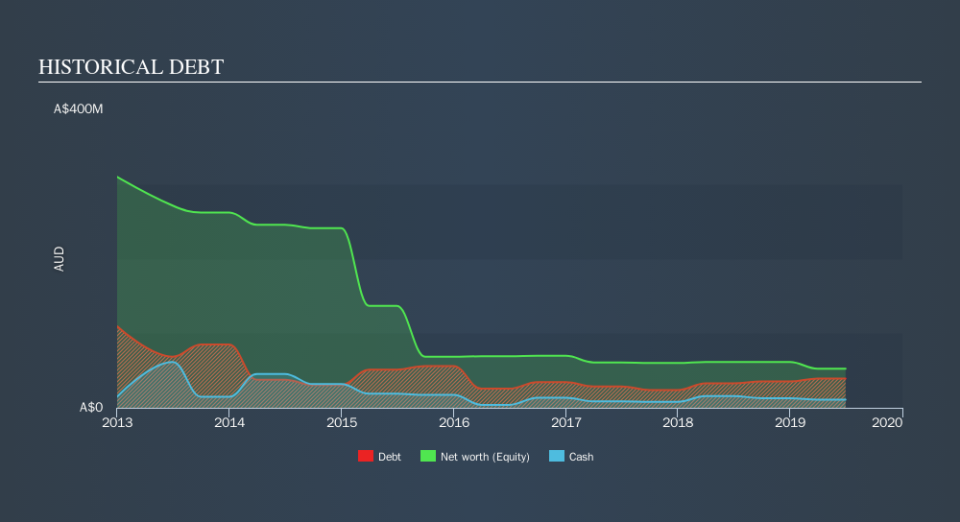

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Hills had AU$39.3m of debt, an increase on AU$32.7m, over one year. However, because it has a cash reserve of AU$10.9m, its net debt is less, at about AU$28.4m.

A Look At Hills's Liabilities

The latest balance sheet data shows that Hills had liabilities of AU$65.4m due within a year, and liabilities of AU$28.0m falling due after that. On the other hand, it had cash of AU$10.9m and AU$57.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$25.3m.

Hills has a market capitalization of AU$48.7m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Hills will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Hills's revenue was pretty flat, and it made a negative EBIT. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Over the last twelve months Hills produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable AU$12m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled AU$9.7m in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Hills insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.